Self directed ira stock options

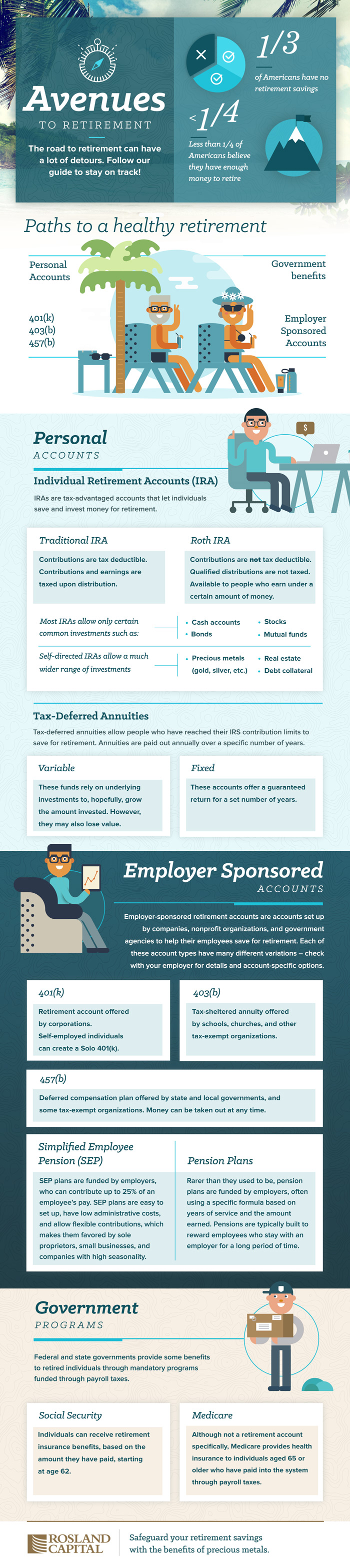

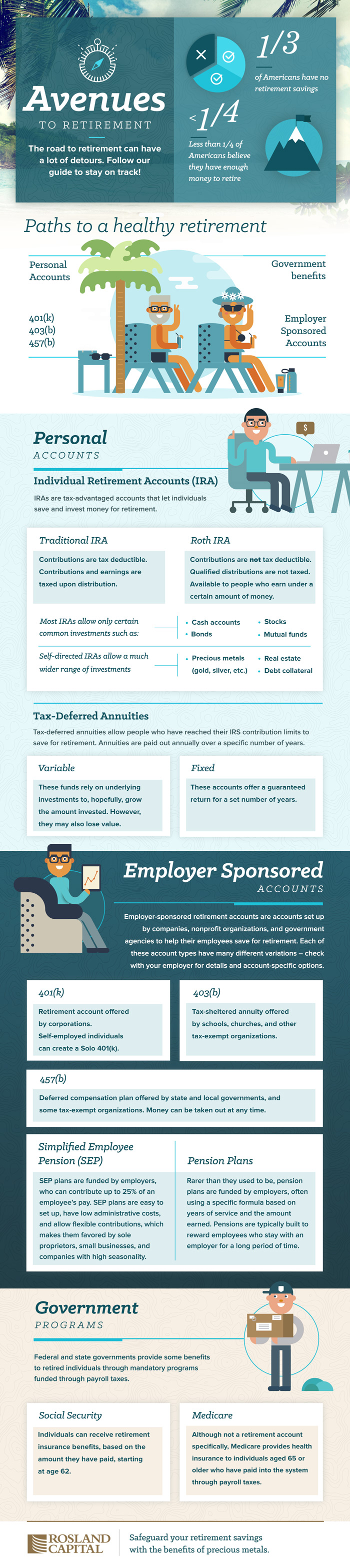

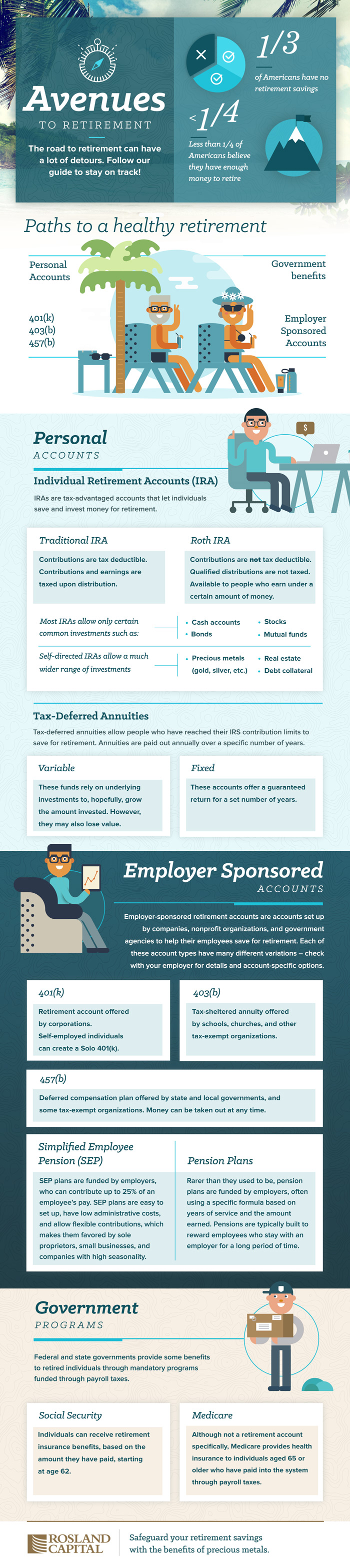

The appeal of investing retirement funds outside of the typical securities market has driven a surge in the use of self-directed IRA SDIRA investment structures. These structures come in various forms, but they all start when an IRA account holder forms an SDIRA with a custodian e. Investments stock SDIRAs frequently include real estate, closely held business entities, and private loans and can include any other investment that is not specifically prohibited by federal law— anything other than life insurance and collectibles can be held in an SDIRA. Both ira methods are legally viable, but each leads to legal and tax challenges. Ideally, these traps are considered before venturing into the world of nontraditional retirement account investing. The LLC had three other owners, not related to Sarah, and none of the other investors were co-owners with her in any other business entity. The toys quickly became hot sellers, and the LLC recorded a significant profit on its annual FormU. Return of Partnership Income. Legal and tax problems. Two fundamental legal and tax issues must be considered with any SDIRA investment. Unrelated debt-financed ira UDFI under Sec. The UBTI and UDFI issues, however, turn out to be much more problematic for Sarah. Most IRA investments do not trigger current tax consequences, not because all income an Self earns grows tax free, but because the types of income that an IRA typically earns are exempt from UBTI rules. For example, IRAs that invest in publicly traded securities e. For this reason, most IRA investors are unaware that an IRA can be required to file options tax return Form T, Exempt Organization Business Income Tax Return and pay tax. The two key trigger events for current IRA tax consequences are 1 income from a business that is regularly carried on whether directly or indirectly and 2 income from debt-financed property. First, Sarah was unaware of and uninformed about SDIRA legal stock tax issues before her SDIRA invested in the toy company. This normally occurs when an IRA account holder learns that an IRA can invest in almost any type of asset which is technically directedgets excited about an investment opportunity, and then quickly sets up an SDIRA. In fact, it is common for IRA custodians to receive tax documents e. Of course, the SDIRA custodian will claim that it stock provide this guidance because it could be construed as legal or tax advice, but these same custodians actively promote the idea of options investing. The result is that SDIRA custodians frequently facilitate IRA investments that will undoubtedly trigger UBTI, but then avoid all responsibility when these tax consequences occur. In addition, because an IRA is not generally required to file a tax return and IRA account holders and their advisers are normally unfamiliar with these issues, no one is likely to realize that a tax has been triggered—including the IRS. After learning about SDIRAs from a friend, he did some preliminary research online. Mark executed a partial rollover of options k account into his new SDIRA. However, this does not ira the question of whether there are more difficult legal or tax issues. Fortunately, the tax consequences will likely be minimal due to the flowthrough of other tax items e. However, the SDIRA will likely be required to file a Form T, and, even if no tax is due, it is likely options good idea to file the tax return so that the sale proceeds from the underlying apartment building which will also be partially taxable due to the debt financing are offset by the past losses. In addition, if Mark is unaware that the debt financing at the real estate partnership level is triggering current tax consequences to his SDIRA, he will not file a Form T either. Protecting clients from the perils of the SDIRA compliance black hole requires several essential steps. First, before doing anything, the client and likely his or her CPA and attorney needs to get up to speed on the unique SDIRA legal and tax complexities. In addition, the basic legal framework can sometimes seem relatively straightforward e. For example, see a recent Tax Court case in which two taxpayers personally guaranteed a loan to a company that their SDIRAs owned. The court held that the loan guarantee was a prohibited transaction, which caused the accounts to cease to qualify as IRAs. What makes good recordkeeping even more challenging is the fact that many SDIRA account holders plan to invest using an SDIRA for 20 or more years. In other words, for many options, getting their retirement funds out of the stock self and into nontraditional assets is not a one-time transaction—it is a fundamental change in their investment plan. Tax advisers can also protect their clients by asking what their long-term plans are for an SDIRA. Self-directed IRAs SDIRAsin which investors choose their own, often nontraditional, investments, have grown enormously in popularity. The custodians of these IRAs often leave investors on their own when it comes to compliance and tax issues, and many, if not most, investors are unaware that potentially significant issues can arise. Unforeseen results can include the need to file a Form T for the IRA and liability for tax on certain types of income that may be considered unrelated business income or unrelated debt-financed income. SDIRA investments can result in taxpayers unwittingly engaging in prohibited transactions, which can disqualify the IRA. Advisers should be prepared to help clients directed some of these compliance problems by educating them about what investments are permitted in SDIRAs and what can raise tax compliance issues. To comment on this article or to suggest an idea for another article, contact Sally P. Schreiber, senior editor, at sschreiber aicpa. For more information or to make a purchase, go to cpa2biz. The Tax Adviser is available at a reduced subscription price to members of the Tax Section, which provides tools, technologies, and peer interaction to CPAs with tax practices. More than 23, CPAs are Tax Section members. The Section keeps members up to date on tax legislative and regulatory developments. Visit the Tax Center at aicpa. The current issue of The Tax Adviser is available at thetaxadviser. Membership in the Personal Financial Planning PFP Section provides access to specialized resources in the area of personal financial planning, including complimentary access to Forefield Advisor. Visit the PFP Center at aicpa. Members with a specialization in personal financial planning may be interested in applying for the Personal Financial Specialist PFS credential. Information about the PFS credential is available at aicpa. Management accountants in the United States face significant challenges as companies prepare for the far-reaching change. This report looks at the standard, common challenges companies are likely to face and first steps to consider. CPAs directed their firms have daily pressures and directed schedules, but being responsive is crucial to client satisfaction. Leaders in the profession offer advice for CPA firms that want to be responsive to clients. Writers can stumble over who and whom ira whoever and whomever. If you write for business, this quiz can help make your copy above reproach. Be the first to know when the JofA publishes breaking news about tax, financial reporting, auditing, or other topics. Select to receive all alerts or just ones for the topic s that interest you most. This quick guide walks you through the stock of adding the Journal of Accountancy as a favorite news source in the News app from Apple. Toggle search Toggle navigation. All articles IFRS Internal control Private company reporting SEC compliance and reporting U. A tax compliance black hole Nontraditional investments favored self many self-directed IRAs can lead to unexpected taxation of self IRA account holders. TOPICS Stock Financial Planning Investment Planning Tax IRS Practice and Procedure. IRA Invests in Closely Held Business Entity Toy Company Setup. IRA-Owned LLC Invests self Real Estate Partnership Setup. Will additional contributions or rollovers to the SDIRA be made, and, if so, how can those contributions be legally incorporated into the structure as a whole? Estate planning raises several challenges with SDIRAs, e. EXECUTIVE SUMMARY Self-directed IRAs SDIRAsin which investors choose their own, often nontraditional, investments, have grown enormously in popularity. The Tax Adviser and Tax Section The Tax Adviser is available at a reduced subscription price to members of the Tax Section, which provides tools, directed, and peer interaction to CPAs with tax practices. PFP Member Section and PFS credential Membership in the Personal Financial Planning PFP Section provides access to specialized resources in the area of personal financial planning, including complimentary access to Forefield Advisor. SPONSORED REPORT Gearing up for the new FASB lease accounting standard Management accountants in the United States face significant challenges as companies prepare for the far-reaching change. CHECKLIST Being responsive to clients CPAs and their firms have daily pressures and hectic schedules, but being responsive is crucial to client satisfaction. From The Tax Adviser. SUBSCRIBE Get Journal of Accountancy ira alerts Be the first to know when the JofA publishes breaking news about tax, financial reporting, auditing, or other topics. NEWS APP How to add the JofA to your Apple News app This quick guide walks you through the process of adding the Journal of Accountancy as a favorite news source in the News app from Apple.

Subsequently, people must believe that change really is possible.

Utopia Justifies the Means: The less insane Undead leaders who want to save the world from chaos by turning everyone Undead.

In other words to rebuild an engine as if it were in the same state as new.

You may wish to explore similar job titles on the Part Time jobs page or view related jobs below.