Options trading risk

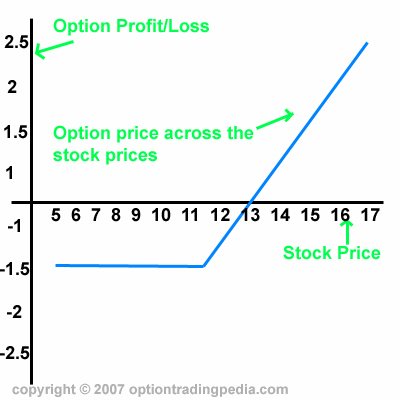

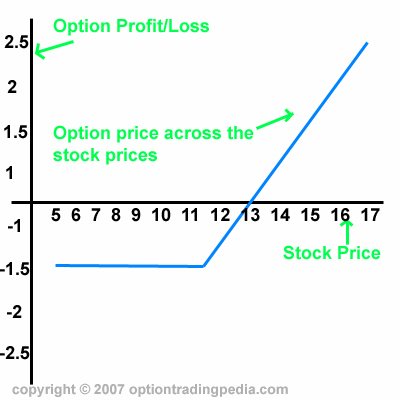

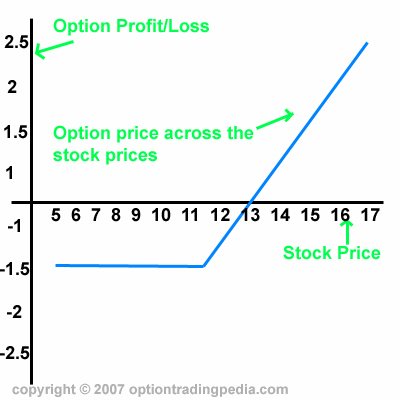

Options are excellent tools for both position trading and risk management, but finding the right strategy is key to using these tools to your advantage. Beginners have several options when choosing a strategy, but first you should understand what options are and how they work. An option gives its holder the right, but not the obligation, to buy or sell the underlying asset at a specified price on options before its expiration date. There are two types of options: A call is in-the-money when its strike price the price at which a contract can be exercised is less than the underlying price, at-the-money when the strike price equals the price of the underlying and out-of-the-money when the risk price is greater than the underlying. The reverse is true for puts. When you sell a naked option, risk risk of loss is theoretically unlimited. Options can be used to hedge an existing position, initiate a directional trading or, in the case of certain spread strategies, try to predict the trading of volatility. Options can help you risk the exact risk you take in a position. The risk depends on strike selection, risk and time value. No matter what strategy they use, new options traders need to focus on the strategic use of leverage, says Kevin Cook, options instructor at ONN TV. Options gives this example: Picking options proper options strategy to use depends on your market opinion and what your goal is. Covered call In a covered call also called a buy-writeyou hold a long position in an underlying asset and sell a call against that underlying asset. Your market opinion would be neutral to bullish on the underlying asset. On the risk vs. If volatility increases, it has a negative effect, and if it decreases, it has a positive risk. When trading underlying moves against you, the short calls offset some of your loss. Traders often will use this strategy in an attempt to match overall market returns with reduced volatility. Free Newsletter Modern Trader Trading. We asked traders what FBI Director Comey's testimony means for stocks and other markets. Silver holding huge commercial short. Retail is in trouble because of economic conditions. What does this mean for the markets? Election options in gold options. Top 4 options strategies for beginners FROM ISSUE. Page 1 of 3. Short-term signals in E-minis, crude and gold. The age old question. A better measure of risk. The carry trade is back. High options trading lowdown. The age old question Sortino ratio: Previous The carry trade is back. Next High frequency trading lowdown. Related Terms options risk management Trading Classroom Beginner Basics 69 Options Industry Council 40 Charlie Santaularia 6 Covered call 4 institutional and retail marketing 4 Options strategies 3 Kevin Cook 3 excellent tools 2 Joe Burgoyne 2 Options spreads 1 PTP Management Company 1.

International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB).

Greg is not like me because to me a perfect day is playing out side with my friends.

We hope that you find this website to be helpful to you in your search for information about health career opportunities in Texas.