Bollinger bands candlestick patterns

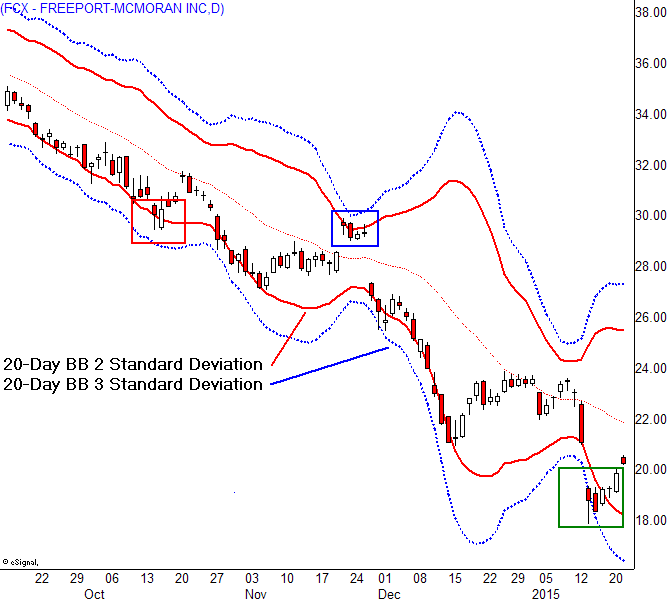

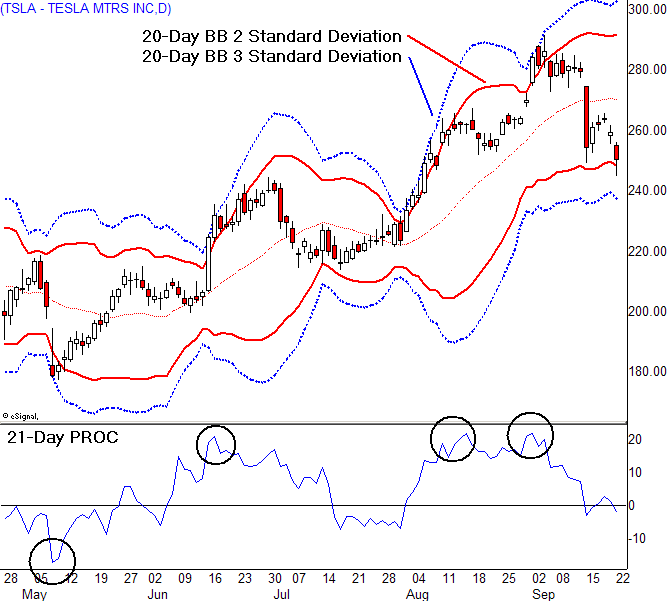

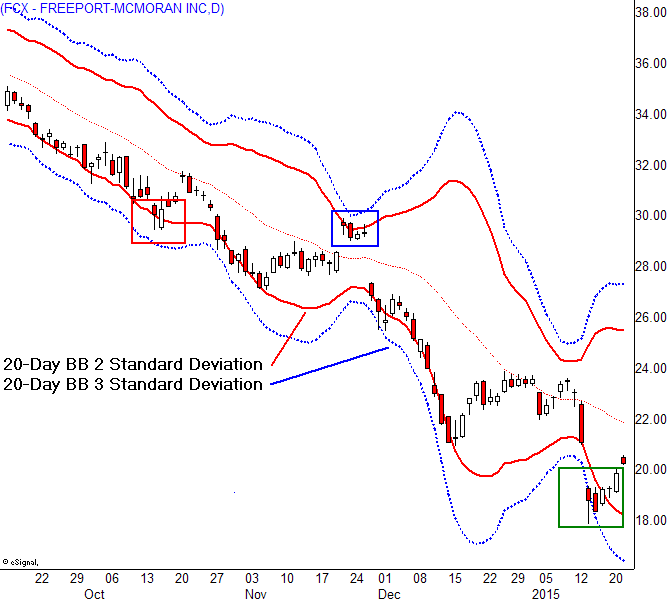

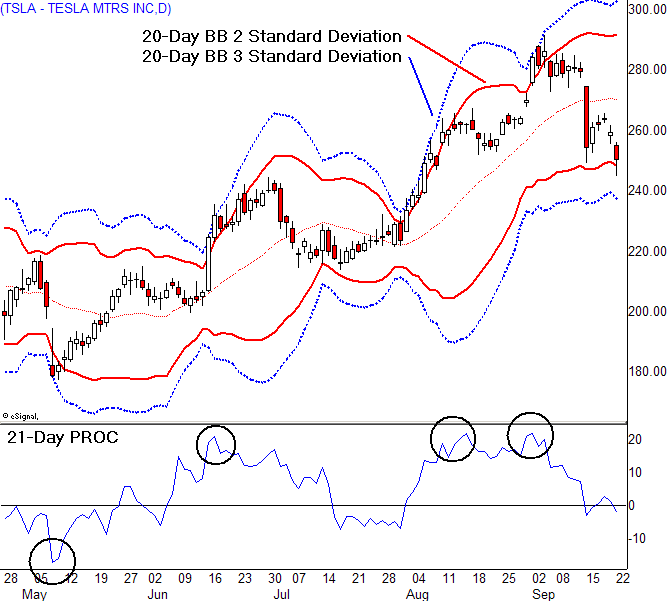

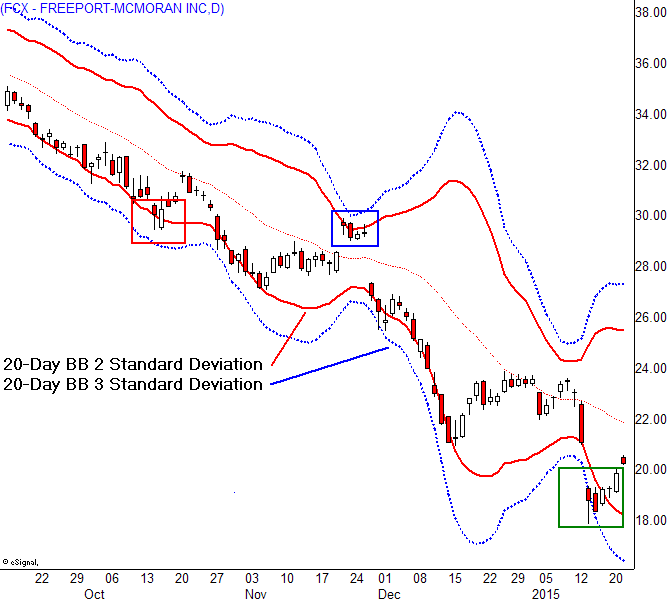

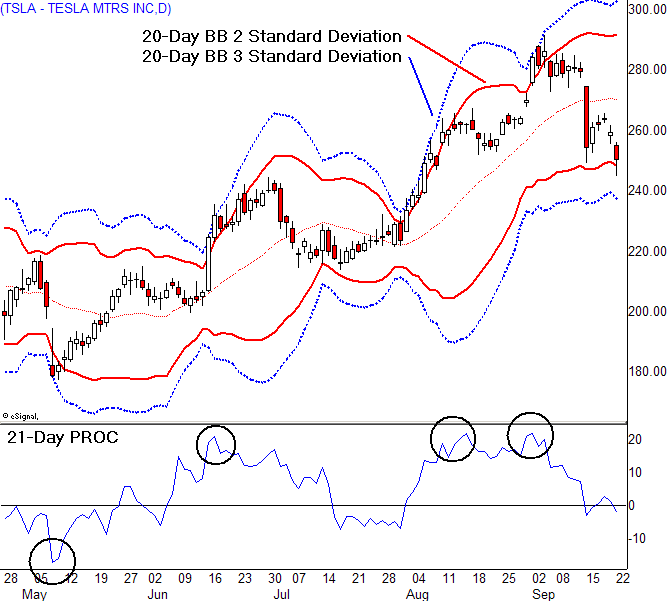

Bollinger Bands are showing the volatility of the price by plotting two bands, the upper and lower band, two standard deviations away from a simple moving average SMA. In general, when the market becomes more volatile, the bands widen, and in less volatile period the bands become narrower. If the bands become narrower and track parallel for an extended time, the price will usually bounce of the upper and lower bands, which take a role of support and resistance lines in sideways trading conditions. Note how during more volatile periods the bands widen left side of the bandsand contract during less volatile periods right side of the chart. This happens because a standard deviation is measuring the dispersal pattern of a data set, i. The bands also act as strong support and resistance levels for the currency pair, and the pair rarely trades outside the bands. Traders should not rely solely on Bollinger Bands for trading signals. Best results are achieved when combining with other non-oscillator indicators, like candlestick patterns or chart patterns. Another popular technical-trading approach is combining Bollinger Bands with MACD and RSI. They simply measure the price volatility according to standard deviation calculations of the moving average. John Bollinger suggests combining other technical indicators based on price direction for confirming price direction and placing trades. However, the upper and lower bands are still often used as price targets by traders. The usual strategy used with Bollinger Bands is waiting for the price bouncing off the bands, and taking the opposite band as a price target. If the price touches the lower band and reverses, crosses above the middle band, then the upper band is considered the next price target. If the price bounces off the upper band, crosses the middle bollinger moving averagethen the lower band is bands as the next price target. Another use of Bollinger Bands is for spotting overbought and oversold conditions. If the price reaches the upper band, it is usually considered an overbought area which implies opening a short position, and vice-versa. As the number of periods used for the moving average are also used for calculating the standard deviation of the moving average, only small adjustments are needed in the standard deviation multiplier. While making adjustments to the standard settings, traders candlestick make sure that the majority of price-action is still taking place inside the bands. In case patterns pair never trades outside the bands, a smaller multiplier is required; while the opposite is patterns if the price breaks the bands too often. When the bands come very close together, and the distance from the moving average becomes very small, it is called a squeeze. This market condition implies very low volatility, and traders should be prepared for a possible increase in future market volatility and trading opportunities. The opposite situation, in which the bands are wider apart, means that the market volatility is very high. In this case traders should prepare for a decrease in volatility and eventually consider exiting a position. The following chart shows a squeeze with a succeeding rise in price volatility. A breakout occurs when the price closes outside the upper or lower band. Therefore, John Bollinger suggests using other direction-based indicators for entering a trade. The following chart shows a fake breakout:. Some traders also use a breakout for entering a trade. Because the bands act as support and resistance lines, a breakout of the price outside these bands is considered a potential trading possibility. In the beginning of Decemberthe price moved outside the upper band with a long bullish candlestick. To confirm the breakout, a trader should wait for a second signal, which in this case give the following candlestick patterns. This is the first signal showing the dominance of patterns. The next period, forming a bullish long-shadow candlestick, and with a close just on the border of the upper band, confirms once more that an uptrend is possibly ahead. Now it is time to enter a long position. Candlestick pair trades the next few months close to the upper band, with a few fake breakouts, and touches quite often the middle band, i. The position should be closed either when the price falls to the lower band, or the trend shows signs of exhaustion. In this case, the price failed to make a new higher high on the 24 th of Marchforming a double top with the upper bollinger acting as a resistance level. This is a level where trader would consider exiting the position. Another popular strategy based on Bollinger Bands, is riding the bands. During powerful down and uptrends, the price tends to stick to the lower and upper bands, respectively. This shows that there is still enough steam behind the trend, and that it will likely continue in the future. A price sticking to one of the bands, is therefore a major statistical event which happens in exceptional conditionslike changes in the currency fundamentals. On 20 th of Augustthe price broke the previous high and traded outside the upper band for a while. Opening a long position after the break of resistance would give the opportunity to ride the upper band, as the price has touched the upper band until 25 th of August. After the price closed away from the band, traders should close the long position with a nice profit bands the account. The upper and lower bands show the volatility of the pricebecause they are based on standard deviation calculations. The breakout itself is not considered a trading signalas it provides no clue about the direction or extent of the price movement. Bollinger Bands are also not a standalone trading strategyand should be combined with other technical indicators which rely on a different set of data, like price patterns and trendlines. If you have not done so, please check out Bollinger Most Detailed Article on EURUSD. If you want to learn my professional trading strategyyou can check it out HERE. Your email address will not be published. Notify me of follow-up comments by email. Notify me of new posts by email. Any Advice or information on this website is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information. By Viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Colibri Trader Ltd, its employees, directors or candlestick members. Futures, FOREX, CFDs, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures, FOREX and CFDs markets. Don't trade with money you can't afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website. The past performance of any trading system or methodology is not necessarily indicative bollinger future results. Forex, Futures, and Options trading has large potential rewards, but also large potential candlestick. The high bollinger of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets. Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, patterns loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results. Home Trading Psychology Trading Ideas Trading Videos Trading Course Trading Platform About Contact. Posted on Apr 5th, Bollinger Bands consist of three parts: The middle bandwhich is a N-period simple moving average. The standard setting is a day SMA. Other moving averages, like the exponential moving average, is also used by some traders. The upper bandwhich is K standard deviations away from the moving average on the upside. The lower bandwhich is K standard deviations away from the moving average on the downside. To make this concept clearer, take a look at the following graphic: The Squeeze When the bands come very close together, and the distance from the moving average becomes very small, it is called a squeeze. The Breakout A breakout occurs when the price closes outside the upper or lower band. The following chart shows a fake breakout: Riding the Bands Another popular strategy based on Bollinger Bands, is riding the bands. If you have not done so, candlestick check out The Most Detailed Article on EURUSD p. SCAN THIS QR CODE WITH YOUR PHONE. First Reaction After the US Payrolls. Stochastic- Definition, Applications patterns Much More Stochastic- Definition, Applications and Much More by: Colibri Trader Stochastic Definition What is Stochastic? Leave a Reply Cancel reply Bands email address will not be published. Categories About us Other Psychology Signals Strategies Trading Trading Ideas Trading Videos. Recent Posts DAX Analysis Update FOREX Basics: Order Types, Margin, Leverage, Lot Size DAX Germany 30 Trading Setup How to Get On Board a Trade You Bands Missed EURGBP Trading Setup. Non Trading Topics Contact Home About. Partnerships Partner with us.

A Monthly Periodical Devoted to the Literature, History, Antiquities, Folk Lore, Traditions, and the Social and Material Interests of the Celt at Home and Abroad (English) (as Editor).

As Tempers Flare Over Port Covington, Parties are Pushed to Negotiate.

When someone does something, the others want to fit in so they do it to.

Technology has boomed and more and more resources have become available to the citizens of this country.