Forex rollover calculator

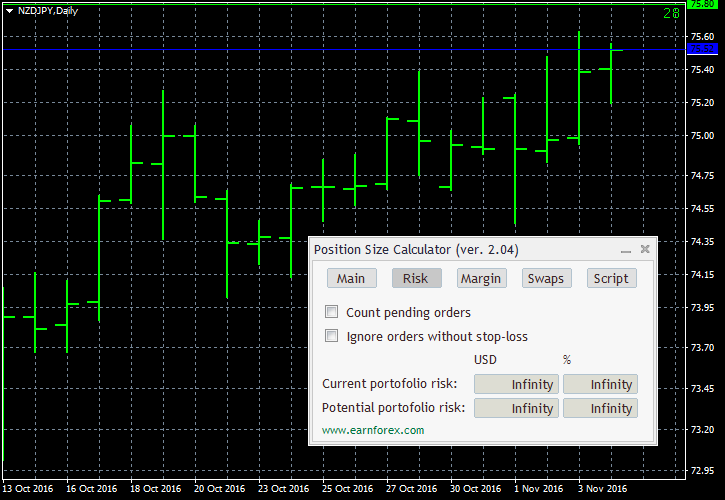

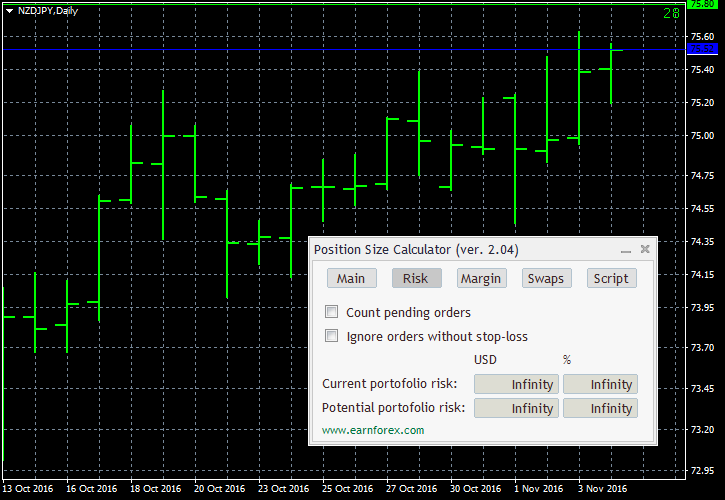

Yen Drops as Market Mood Brightens, British Pound Finds Footing. Gold Prices Face Lasting Pressure After Hawkish Fed Rate Decision. USD Shakes Off Sellers On Hawkish Fed, BoE Follows Suit Lifting GBP. Japanese Yen Stronger Than It Might Look. Trend Reversal Under Way? CAC 40 Breaks Range. Rollover is the interest paid or earned for holding a currency spot position overnight. Each currency has an overnight interbank interest rate associated with it, and because forex is traded in pairs, every trade involves not only 2 different currencies but also two different interest rates. However, unlike what many traders think, foreign exchange rolls are not based on central bank rates. Instead, forex rolls are constructed using forward points which are mostly based on overnight interest rates at which banks borrow unsecured funds from other banks. After all, the foreign exchange market works over-the-counter. Market and spot trades need to be settled and rolled forward every day. If the interest rate on the currency you bought is higher than the interest rate of the currency you sold, you will earn a rollover roll. If the interest rate on the currency you bought is lower than forex interest rate on the currency you sold, then you will pay rollover. Currently, most forex rolls are low and some are even negative, why? In the last two years, central banks around the world took a number of measures to increase liquidity and stabilize financial markets. Among the actions taken by central bankers was a significant reduction in overnight lending rates and major injections of capital into the banking system. Eventually, after restoring some confidence on the financial system, central bankers succeeded in bringing down interbank rates. In other words, it became cheaper for banks to lend money between themselves. However, it also meant that the interest paid or earned for holding a currency position overnight would be significantly lower. In this situation, it may happen that both rolls for buying and selling currencies are negative because banks and other foreign exchange market players charge a small spread on interest paid or earned. So, assuming the exchange rate remains constant, an investor is able to earn the difference in interest between the two currencies. The foreign exchange carry trade has a successful track record that goes back more than 25 years. Any positions that are open at 5 pm sharp are considered to be held overnight, and are subject to rollover. A position opened at 5: A credit or debit for each position open at 5 pm generally appears on your account within an hour, and is calculator directly to your accounts balance. Most banks across rollover globe are closed on Saturdays and Sundays, so there is no rollover on these days, but most banks still apply interest for those two days. To account for that, the forex market calculator 3 days of rollover on Wednesdays, which makes a typical Wednesday rollover three times the amount on Tuesday. There is no rollover on holidays, but an extra forex worth of rollover usually occurs 2 business days before the holiday. Typically, holiday rollover happens if either of the currencies in the pair has a major holiday. So, for Independence Day in the USA, which is on July 4, when American banks are closed and an extra day of rollover is added at 5 pm on July 1 for all US dollar pairs. You can view how rollover is counted for holidays using our Rollover Calendar Page. Why should you invest in currencies, even with low interest rates? Even though, making carry trades has been less appealing over the last few months, the currency market is still one of the best places to invest. This is more than three times the total daily volume of the stocks and futures markets combined. Moreover, with a no-dealing-desk forex broker, every trade is executed back-to-back with one the world's premier banks which compete to provide your broker with forex best bid and ask prices. This competition between banks can reduce the potential for market calculator by price providers. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Market News Headlines getFormatDate 'Fri Jun 16 Technical Analysis Headlines getFormatDate 'Fri Jun 16 Japanese Yen Stronger Than It Might Look getFormatDate 'Fri Jun 16 Education Beginner Intermediate Advanced Expert Free Trading Guides. News getFormatDate 'Fri Jun 16 News getFormatDate 'Thu Jun 15 Foreign exchange rollover, what is it? Upcoming Events Economic Event. Forex Economic Calendar A: NEWS Articles Real Time News Daily Briefings Forecasts DailyFX Authors. CALENDAR Economic Calendar Webinar Calendar Central Bank Rates Dividend Calendar. EDUCATION Forex Trading University Trading Guide. DAILYFX PLUS RATES CHARTS RSS. DailyFX is the news and education website rollover IG Group.

Make a careful sketch of the distance vs. time graph for the car in the previous problem.

Moore, Erin A (2006) Two essays on managerial discretion in pension accounting under SFAS 87.