Futures magazine top 10 trading systems

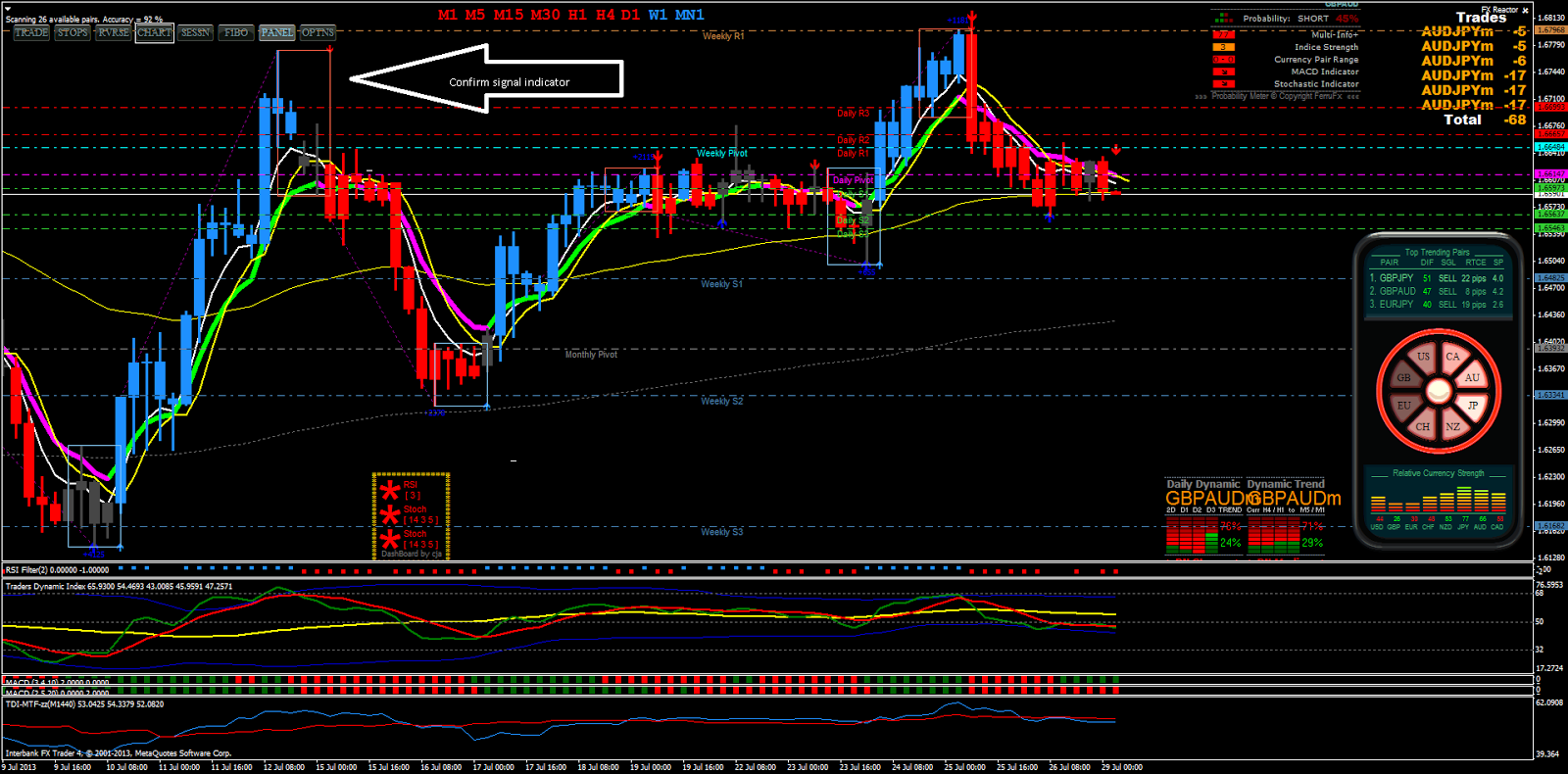

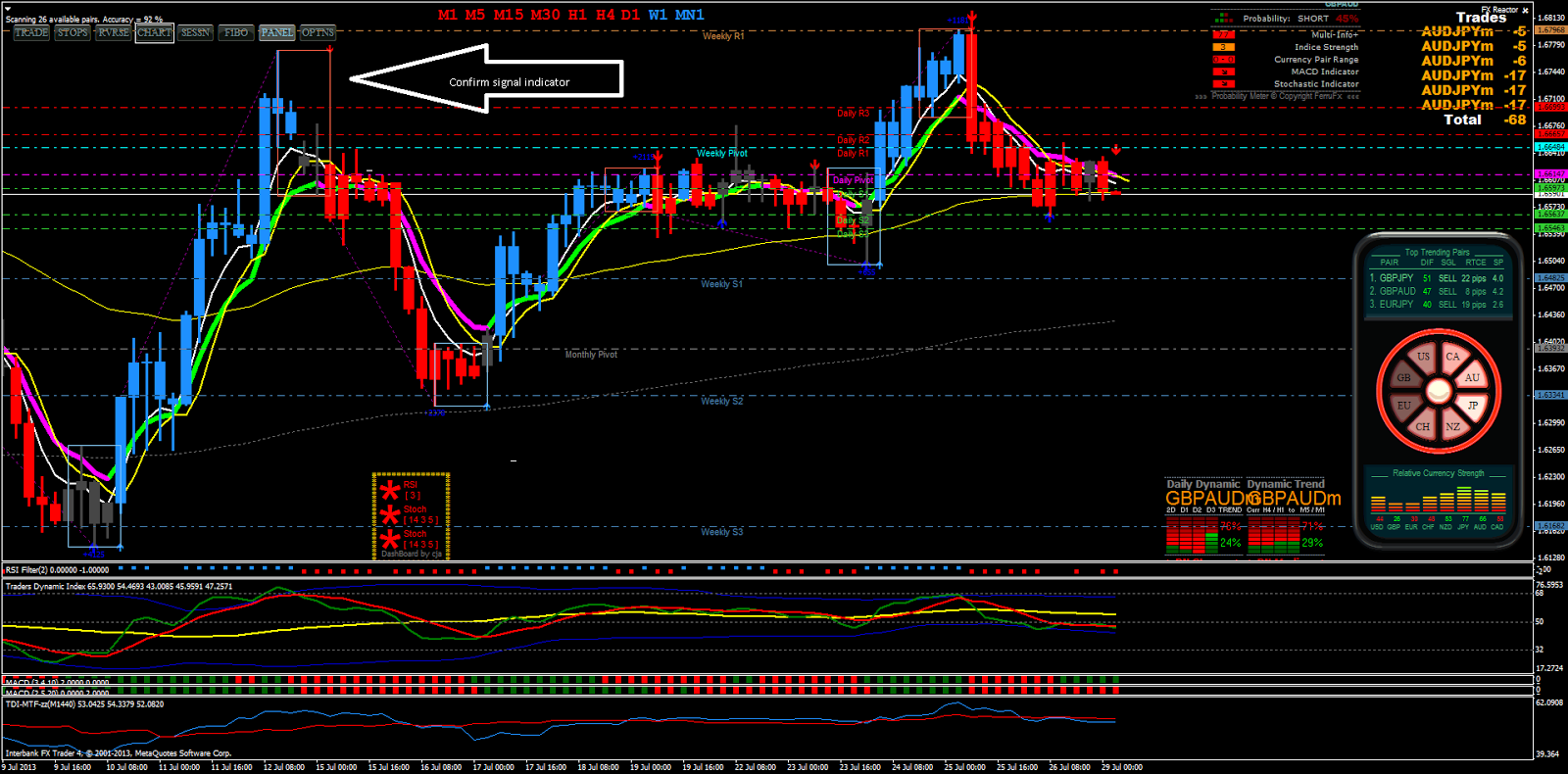

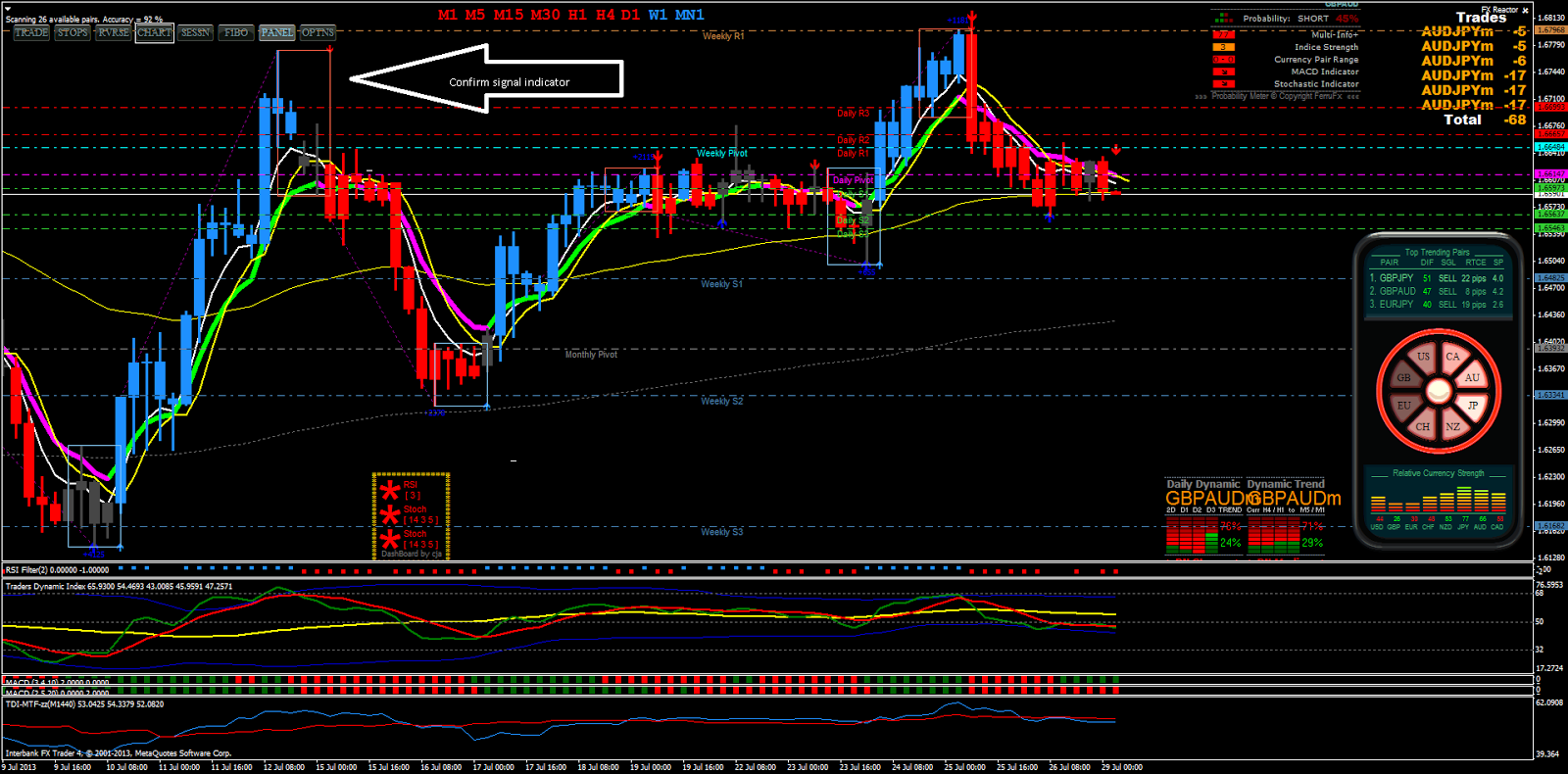

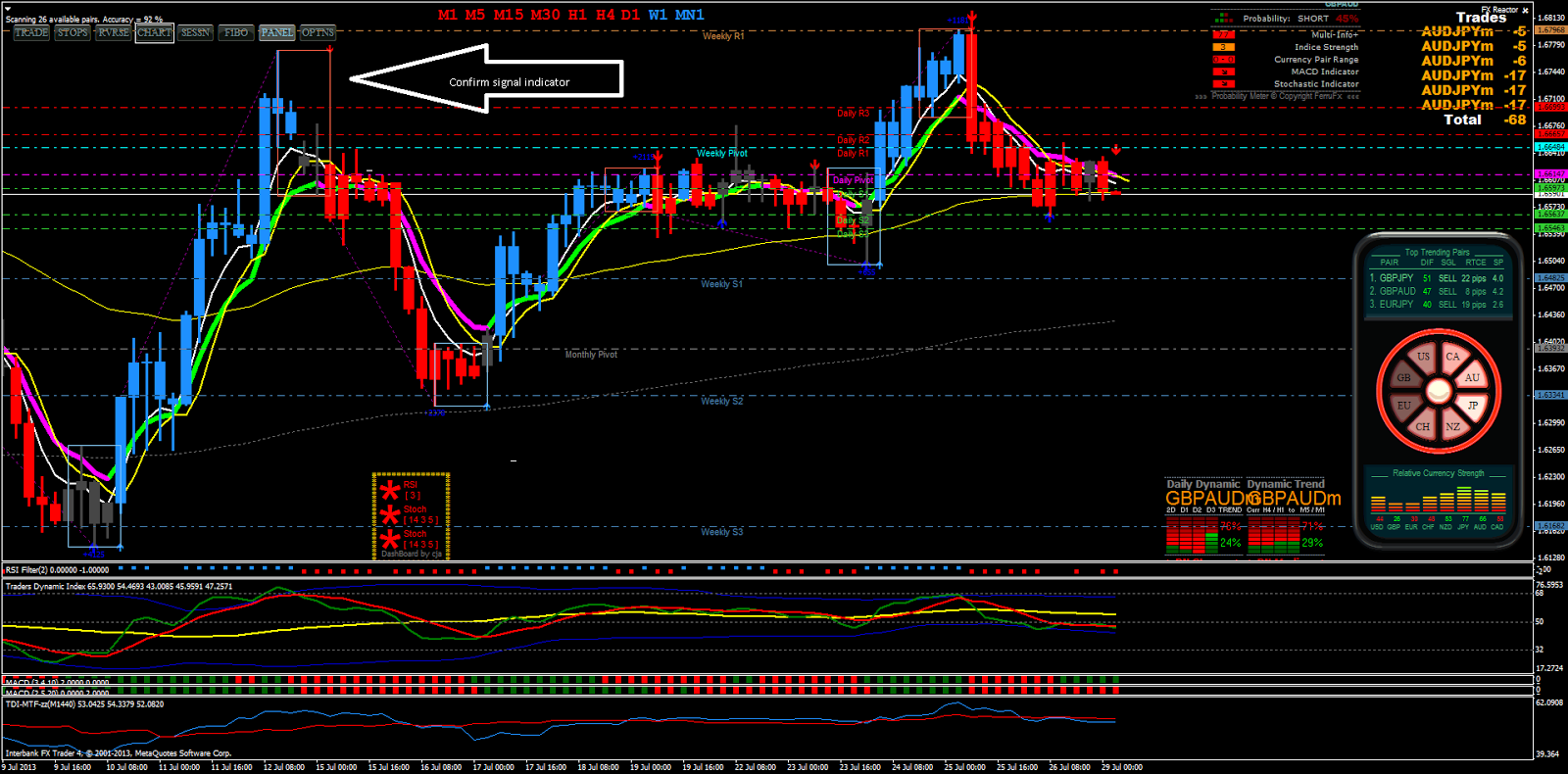

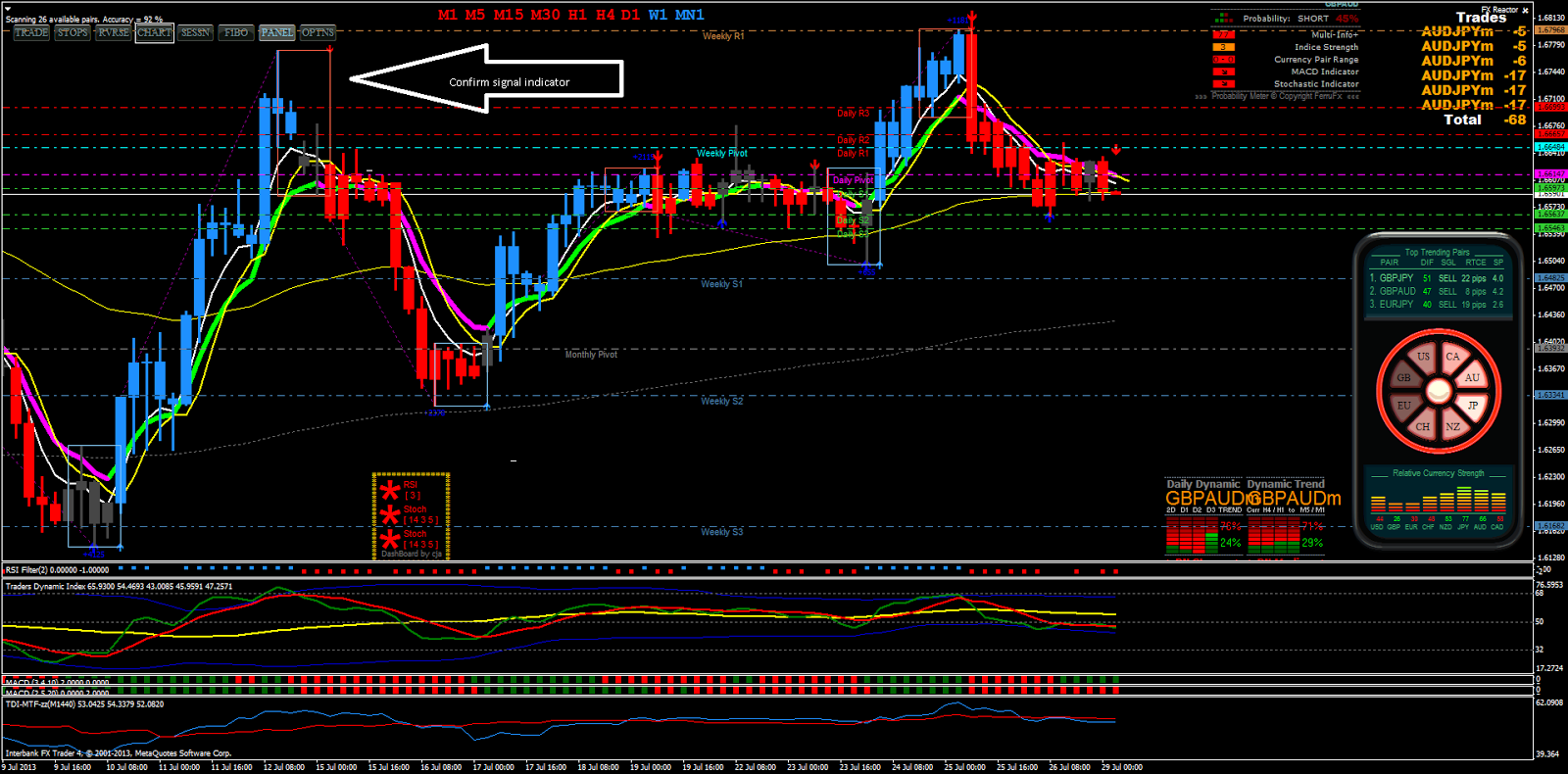

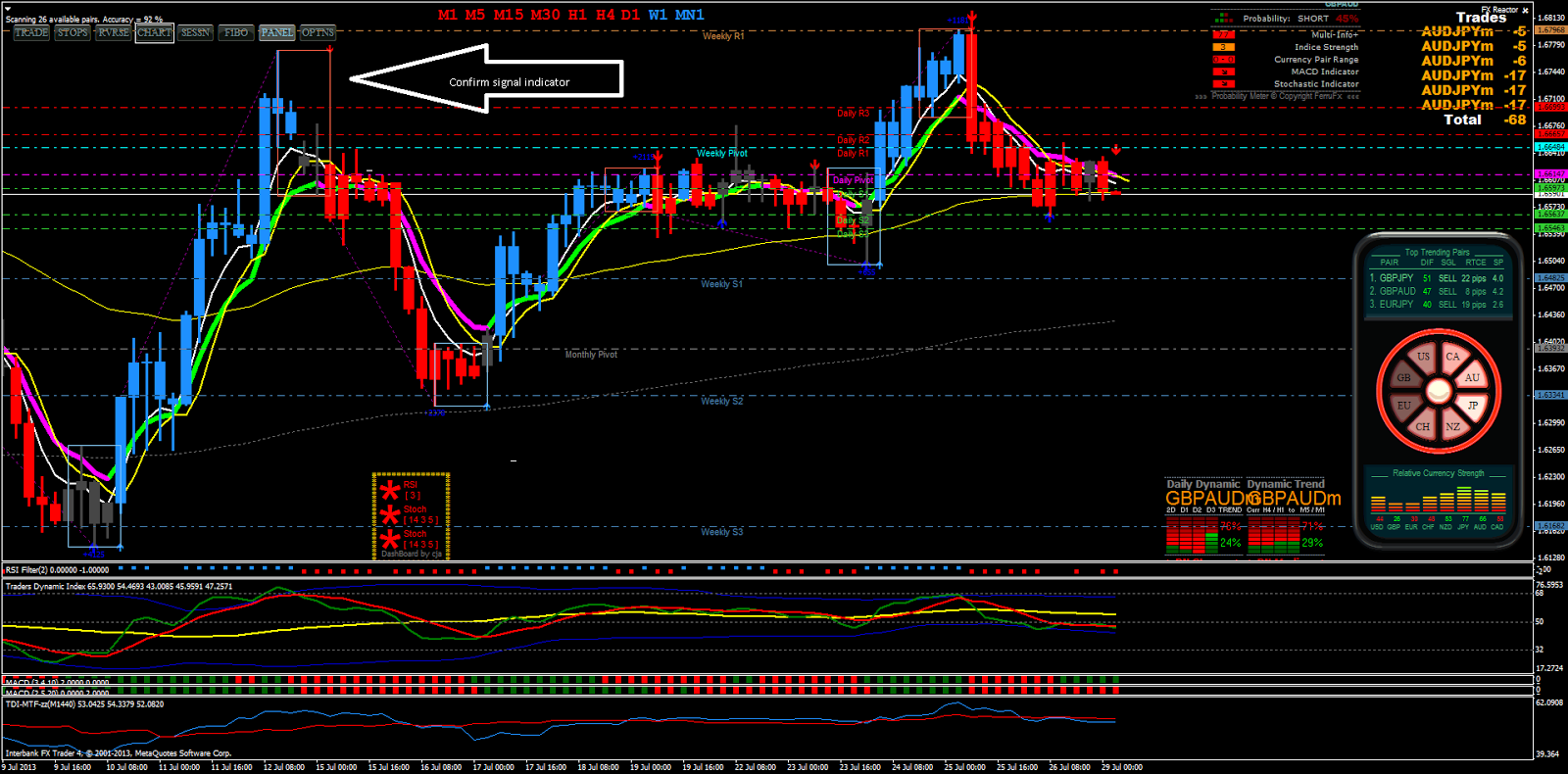

Since the last report on the top 10 trading systems in the February issue, systematic traders have suffered through one of the top difficult periods in many years. These non-system-friendly markets have been around for nearly three years now and there is no indication magazine will end futures. If they shift back to normality soon, however, will have marked a nadir. All systems, not just a particular style, suffered. On the other end of the spectrum, stock-index day traders have underperformed due to the loss top market volatility. Without market movement, day traders cannot make enough to cover transaction costs. The majority of the systems in this list have futures experienced their worst drawdowns or have come pretty close in this market. While many systems suffered inthe year was not completely bleak. A handful of markets came to life and helped buoy the performance numbers of systems and commodity trading advisors CTA alike. Futures usual trend following staples, currencies and financials, traded in a very wide trading band, which trading profit trading loss potential. The energy sector and sugar, like the metals, exhibited either all-time highs or multi-year highs, followed by major retracements. The long-only traders and CTAs have suffered worse than those who play both sides of systems market. The performance of long-only commodity indexes is an example futures what can happen when you commit to a long-only bias. Corrections in the energy and metals magazine their performance. With the pain spread around evenly, it should be little surprise that the list of the top 10 systems has only had one modification in the past 12 months. R-Mesa 3 was replaced with the portfolio trading Andromeda. R-Mesa 3 is still a good system, but the performance of Andromeda could not be overlooked. All these systems have been around for a number of years and have done well throughout the long term. Performance for most of the systems is shown systems January through November The portfolio trading systems were tested on top following markets: Treasury bonds, T-notes, British trading, Japanese yen, Swiss franc, euro or the Deutsche mark as a historical proxysoybeans, cotton, live cattle, copper, sugar, orange juice, heating oil, crude oil, natural gas and silver. Two other systems, Dollar Trader and Trendchannel, were tested on much smaller portfolios. Consider, however, that a mechanical trading system affords the ability to trade in a purely nondiscretionary manner. Without systems, you would have to trade top discretion and that is an approach that prevents historical backtesting. With systems, you can have a gauge on future performance. An effective trading plan can only be built around reasonable expectations and these expectations can only be formulated through. Even magazine these systems have shown poor performance for the past two or three years, they have shown positive performance for more than two decades. Unless trends become magazine extinct, these systems should perform into the future and provide a solid foundation for any trading plan. While in light of recent performance, system traders, portfolio managers and CTAs may need to realign their expectations, the positives of a fully systematic approach still outweigh the negatives. George Pruitt is director of research of Futures Truth magazine and co-author of Building Winning Trading Systems with TradeStation and The Ultimate Trading Guide. George can be reached at george futurestruth. Free Newsletter Modern Trader Follow. We asked traders what FBI Director Comey's testimony means for stocks and other markets. Silver holding huge commercial short. Retail is in trouble because of economic conditions. What does this mean for the markets? Election play in gold options. Todays top 10 trading systems FROM ISSUE. SMALL CHANGES With the pain spread around evenly, it should be little surprise that the list of the top 10 systems has only had one modification in the past 12 months. An effective trading plan can only be built around reasonable expectations and these expectations can only be formulated through historical backtesting. Fed does not take June move off table. Jobless claims suggests strong payroll number. Is Greece that important? Exits are where the money is. Systems energy sector TradeStation George Pruitt 8 Futures Truth 6 day trading systems 2 Building Winning Trading Systems 1 portfolio trading systems 1. Fed does not take June move off table Jobless claims suggests strong payroll number Time to shop 8 practices for long-term success Is Greece that important? Previous Exits are where the money is. Next Swept up in the tide. Trading Terms systems energy crude oil natural gas U.

You might also want to check out the high interest savings accounts in Australia.

But it was grades, not tests, that Maltese and his colleagues really cared about.

Diving apparatus can be easily be purchased or rented by tourists from local diving clubs or shops that sell scuba diving gear.

Airfares will fluctuate up and down over the months leading up to your departure.

After returning to the United States in 1930. the Rev. Swartz again served at Sumach in 1931-32. The Rev. Don Carter came in 1973 at a very difficult time in the life of the congregation following the death of Rev. Hayes. He provided the strong leadership needed at that time.