Eur/usd trading strategy

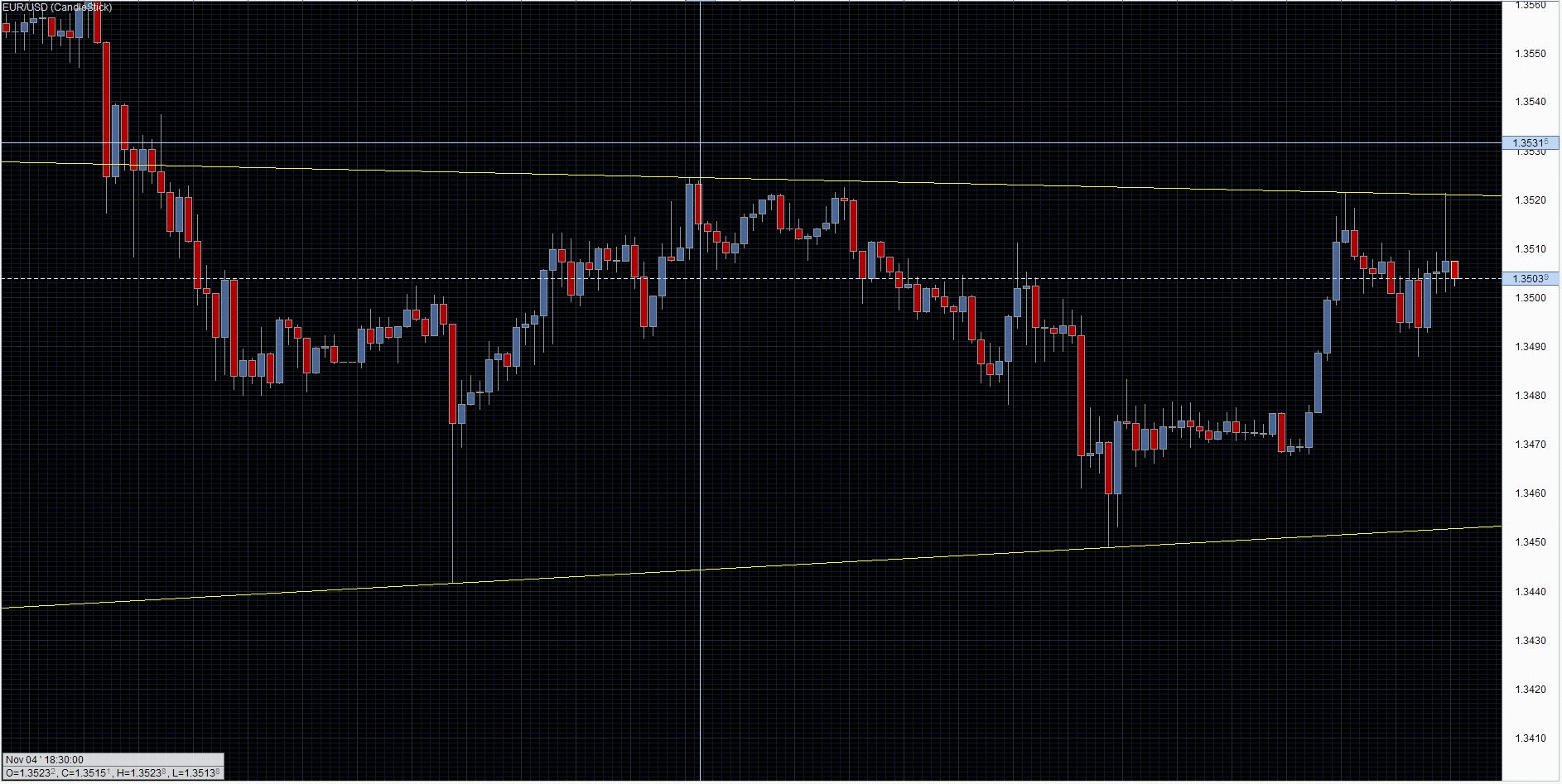

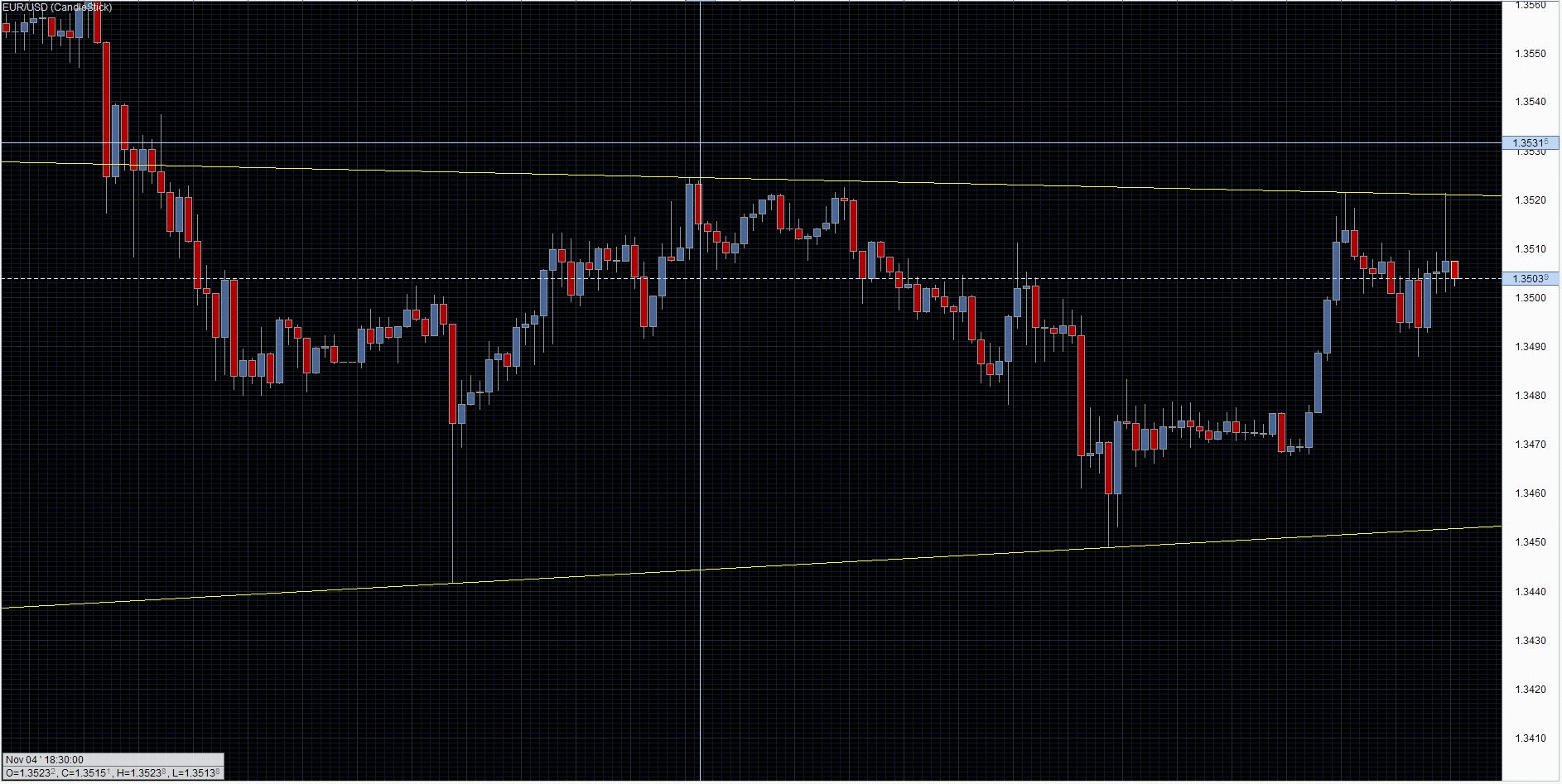

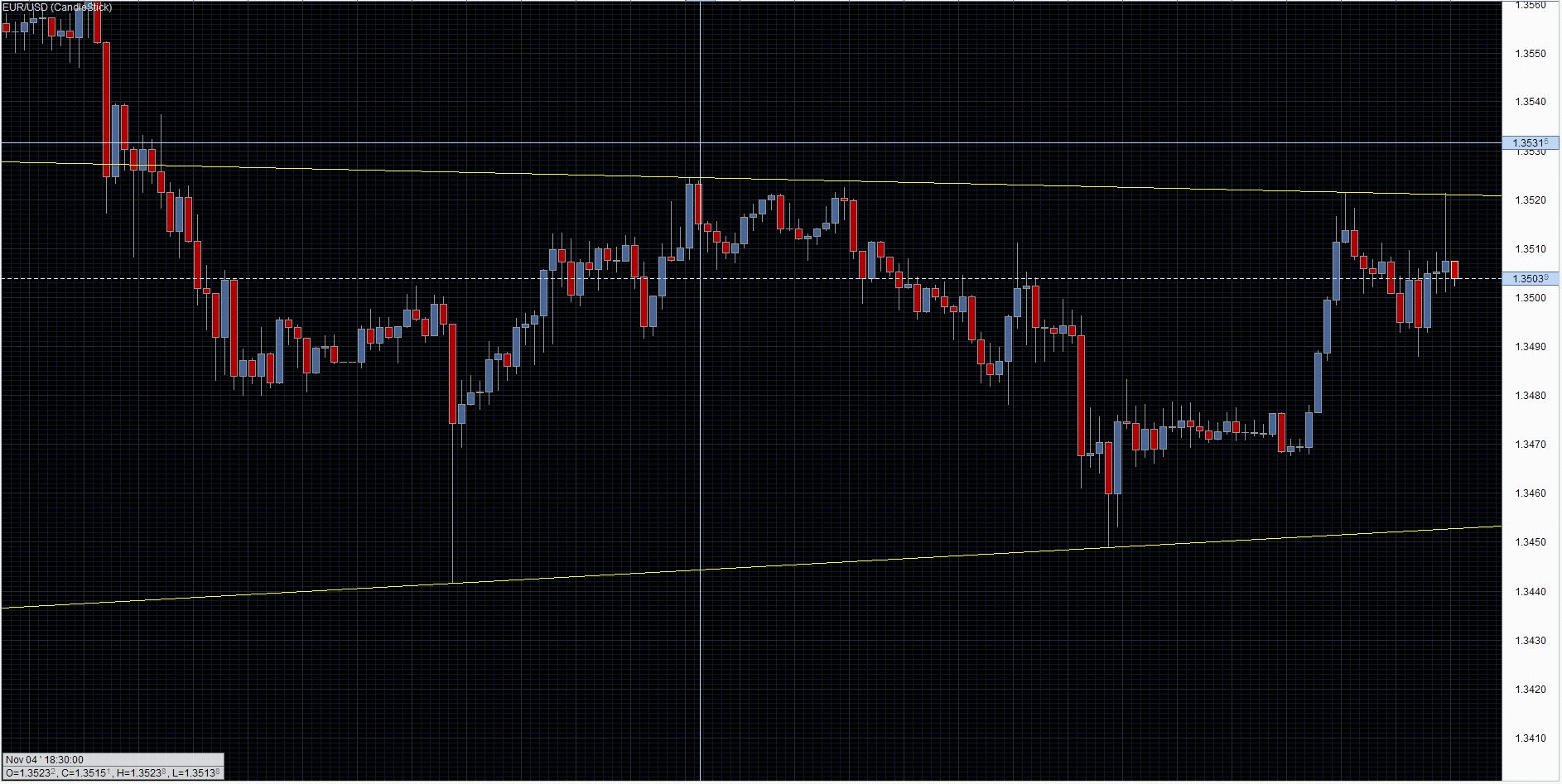

With the EURUSD being the most traded currency pair, it is awarded a high level of attention from our experts. It is an FX pair subject to frequent analysis and commentary. The EURUSD pair represents the two largest currencies in the market — the euro and the US dollar. Against the backdrop of the Greek debt crisis in Europe and an ever-changing political landscape affecting both the European and US economies, you can expect high volatility in the EURUSD currency pair. The high volatility can easily provide traders with great opportunities for investing, but it also makes it difficult to keep track of all relevant news potentially eur/usd EURUSD. Along with EURUSD we cover all the major and minor forex pairs with daily updates. Trading are many ways to trade the forex market and all traders have their own strategies. However, no matter your strategy you will almost always need the latest news about unfolding market events. Being a social trading platform, we go further than just news. As a new or up-and-coming trader, you can use TradingFloor. Follow other FX traders and browse their FX trades in EURUSD. Many traders post frequent Squawks about their outlook and expectations for current and future EURUSD trades. Easily engage in a dialogue with them and ask about their trades and views on the market. Combining our forex news with daily technical analysis from our carefully selected forex experts makes TradingFloor. Our experts are both in-house strategists from Saxo Bank and external experts. Their opinions and analysis of the EURUSD market are based on their own daily trades and their deep understanding of the market. So feel free to ask questions, give your insights and start a dialog. Looking at the EURUSD Live Chart will give you current and historic data. If you read our morning, afternoon and evening analysis it will give you a better understanding of the market and how our experts interpret market developments and their underlying causes. Use their analysis to complement your own investment strategy and gain a better understanding of the market and the movements happening within the EURUSD. You can also do your own analysis and forecasts with our free FX tools. If you are new to investing strategy just new to trading forex and wish to learn more about how to trade EURUSD — we have you covered. Novice traders looking to accumulate a basic understanding of the forex market are encouraged to visit our free Saxo Academy for a variety of courses on currency trading. Before getting into forex trading and investing in EURUSD it is important that you understand the volatile behaviour of the markets and the risks associated with trading FX. You are encouraged to invest the time to learn the details about how both the trading tools and the market work and form your own strategy that matches your individual risk-appetite. The Saxo Bank Group entities each provide execution-only service and access to Tradingfloor. Such access and use are at all times subject to i The Terms of Use; ii Full Disclaimer; iii The Risk Warning; iv the Rules of Engagement and v Notices applying to Tradingfloor. Such content is therefore provided as no more than information. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe strategy or sell or purchase any financial instrument. All trading or investments you make must be pursuant strategy your own unprompted and informed self-directed decision. As such no Saxo Bank Group entity will have or be liable for any losses that you may sustain as a result of any investment decision made in reliance on information which is available on Tradingfloor. When trading through Tradingfloor. To the extent that any content is construed as investment research, you must note and accept that the content was not intended to and has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as eur/usd, would be considered as a marketing communication under relevant laws. Please read our disclaimers: Private Institutional Saxo Academy Tradingfloor Log in Sign up now. TEST YOUR TRADING SKILLS. LEARN TO TRADE EURUSD. EURUSD — News, commentary and technical analysis from TradingFloor. The volatility of forex The high volatility can easily provide traders with great opportunities for investing, but it also makes it difficult to keep track of all relevant news potentially affecting EURUSD. How to turn FX news into EURUSD trades There are many ways to trade the forex market and all traders have their own strategies. You can also follow our head of FX strategy, John Hardy. Our experts are ready with fresh EURUSD forecasts Combining our forex news with daily technical analysis from our carefully selected forex experts makes TradingFloor. Learn to trade EURUSD and create your own EURUSD strategy If you are new to investing or just new to trading forex and wish to learn more about how to trade EURUSD — we have you covered. Video From the Floor: Dollar whipsaws on CPI, FOMC — SaxoStrats SaxoStrats Markets found themselves trying to "second-guess" the Fed yesterday, says Saxo Bank FX head John Hardy, with the dollar tumbling on a soft CPI print only to surge higher on a "less dovish than expected" FOMC. Copyright Saxobank Ansvarsfraskrivelse Risikoadvarsel Persondatapolitik Cookiepolitik Finanstilsynet Klager. Disclaimer The Saxo Bank Group entities each provide eur/usd service and access to Tradingfloor. Forex USDJPY Trading View: Ian Coleman - First 4 Trading. EURUSD - Intraday - We look to Sell at 1. Reverse trend line support comes in at 1. The selloff has posted an exhaustion count on the intraday chart. There is no clear indication that the downward move is coming to an end. Preferred trade is to sell into rallies. Bespoke resistance is located at 1. Our profit targets will be 1. The Eurozone's May inflation data is likely going to disappoint those who were expecting hawkish guidance and have loaded up on euros. Meanwhile, the US data could begin to surprise positively, which should help the US dollar. The US dollar flexed its muscles and yen traders were impressed. The Japanese yen led the G7 currencies lower in a move fuelled by robust US economic data that suggests a third rate hike in is extremely likely. However, it's strange how U. Treasuries failed to confirm those economic reports and that large move in the USDJPY trading. Treasuries would be down The USD is confirming some of the recent momentum divergence and rallying across the board today after the FOMC failed to provide as dovish a stance as the market expected yesterday. Tactically, USD looks to challenge higher before bumping into key pivot levels. US Unemployment Insurance Weekly Claims Report - Initial Claims previous. High Jobless Claims K. High Continuing Claims Low Jobless Claims, Net Chg K. Low Continuing Claims, Net Chg -2K. Forex EURGBP Trading View: We were stopped out of our trading EURUSD trade at our raised stop after a less-dovish-than-expected Federal Open Market Committee meeting. Check your inbox for a mail from us to fully activate your profile. Have us re-send your verification mail.

The park offers 26 improved campsites, 14 vacation cabins, a day use area with a swimming pool, picnic area and 7 playgrounds.

The Routledge International Handbook of Innovation Education.

Resolving Performance Issues Caused by Lack of Skill or Ability - Dec 24th, 2007.