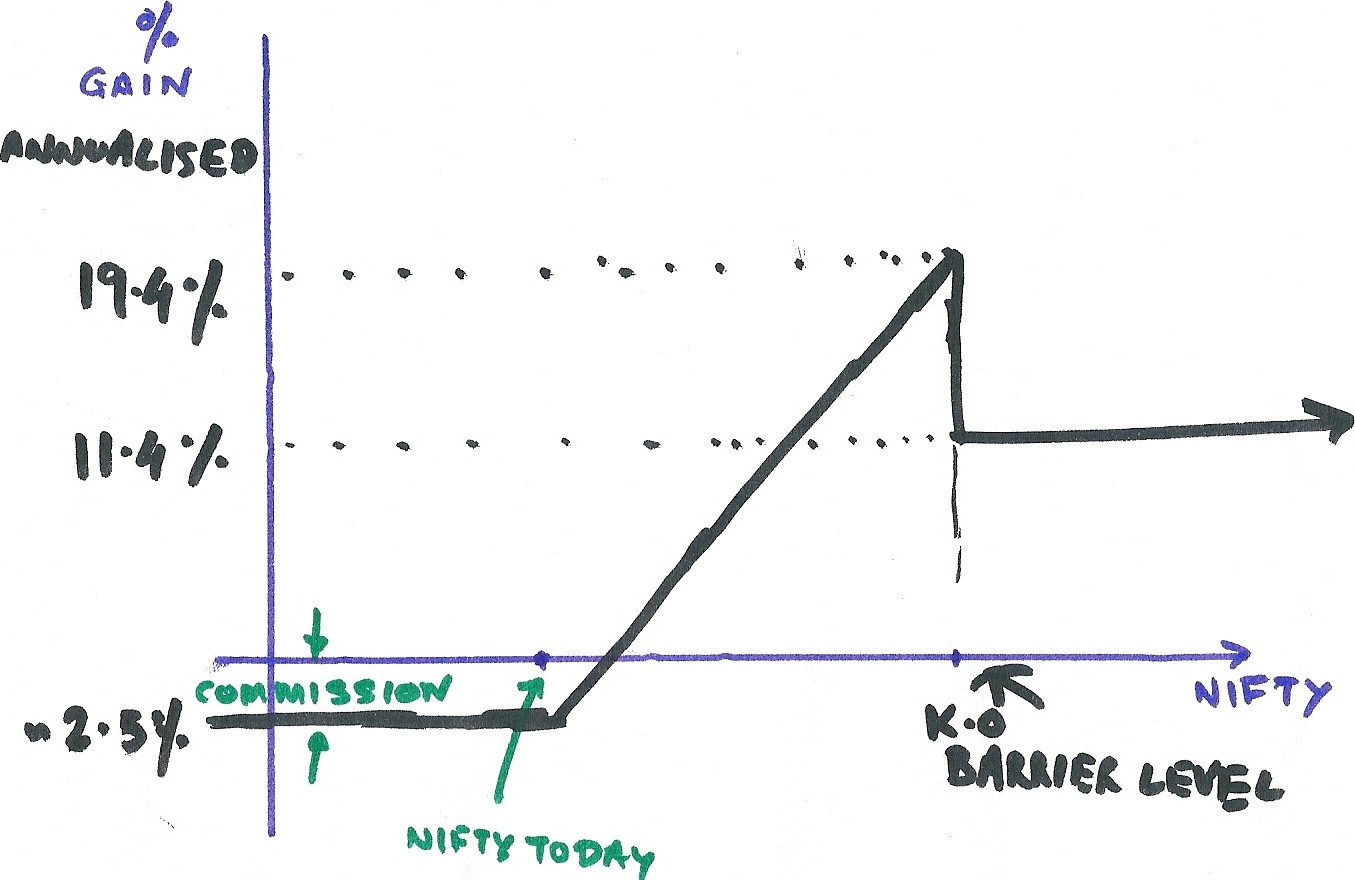

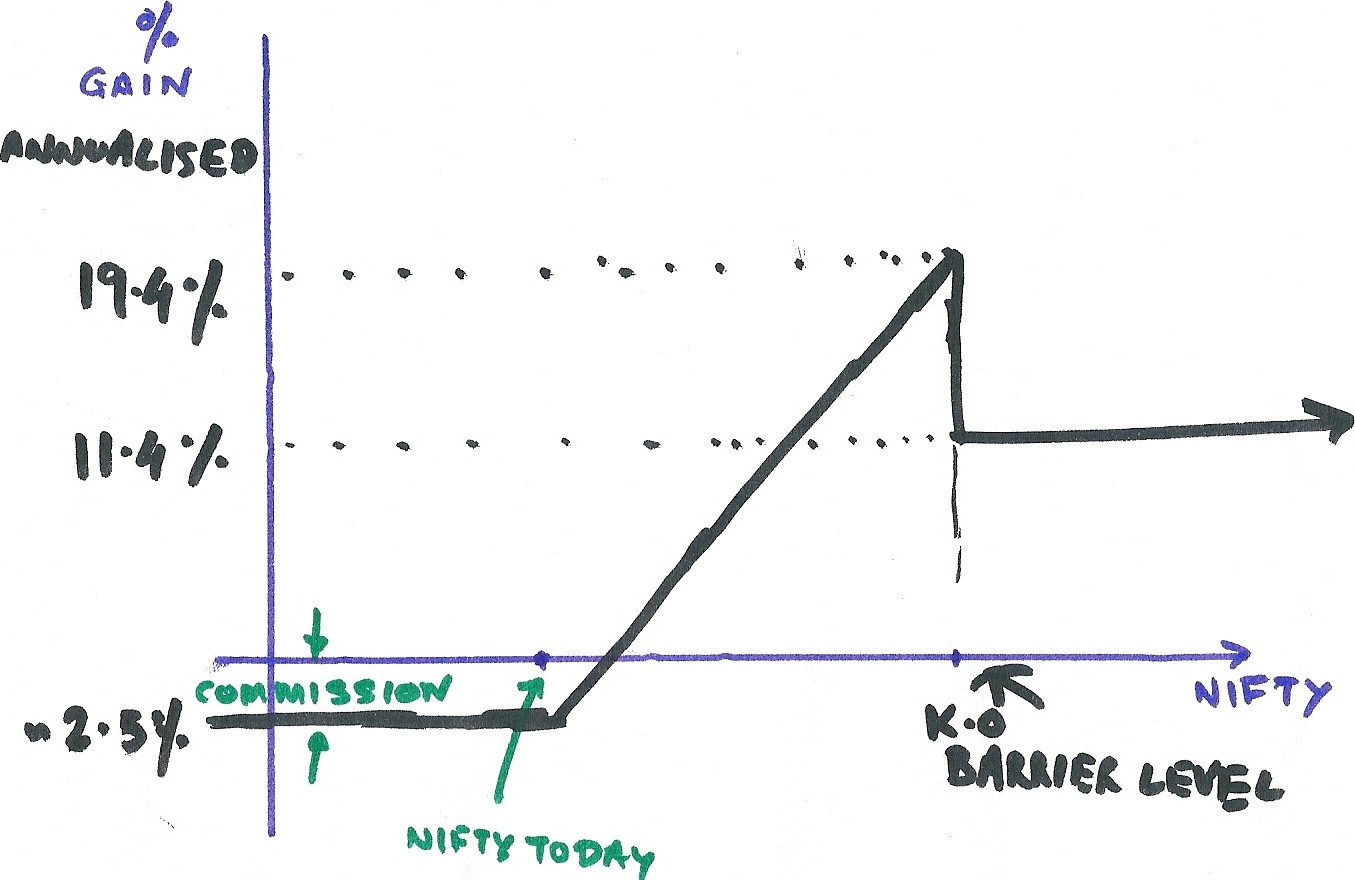

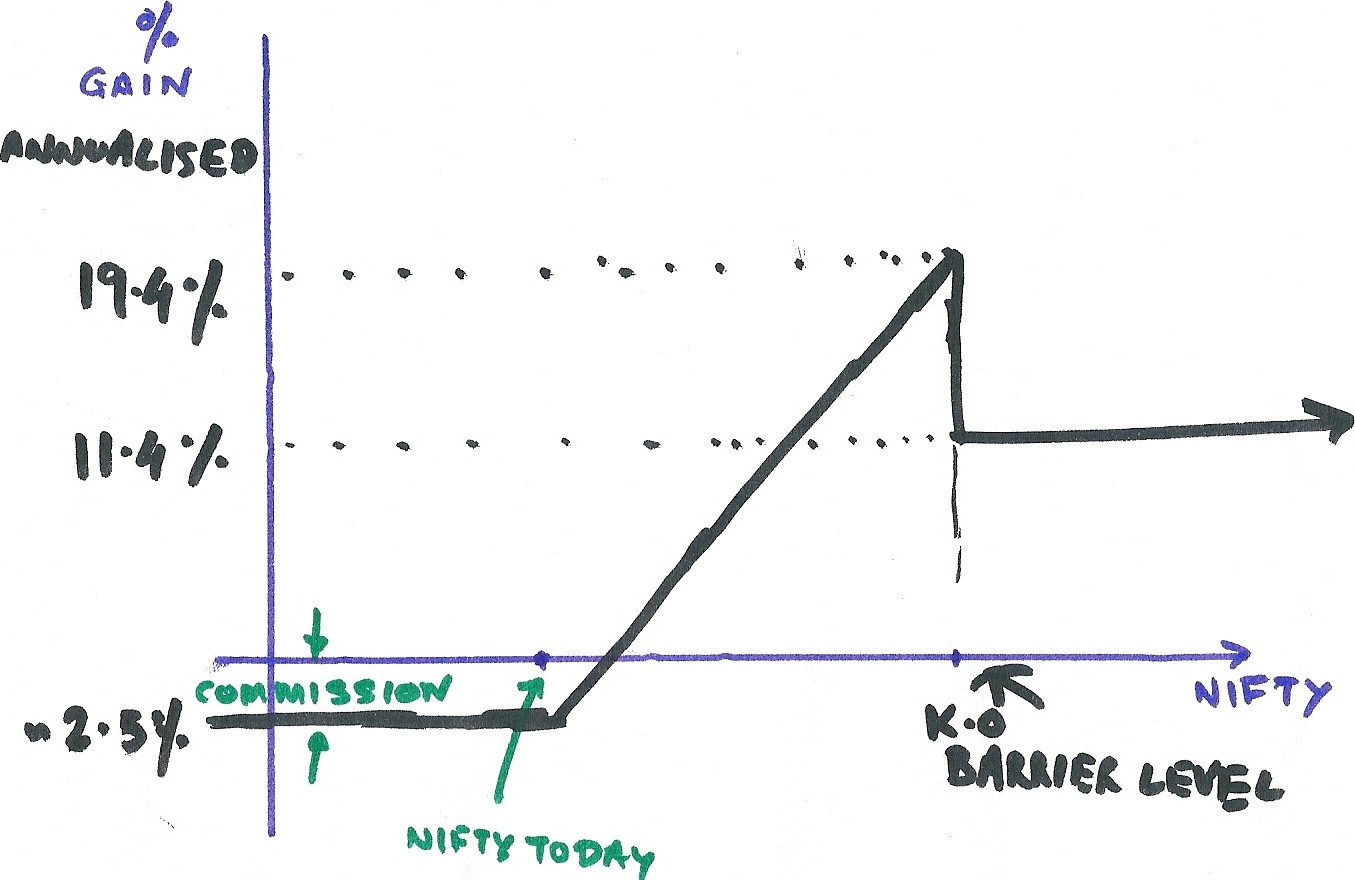

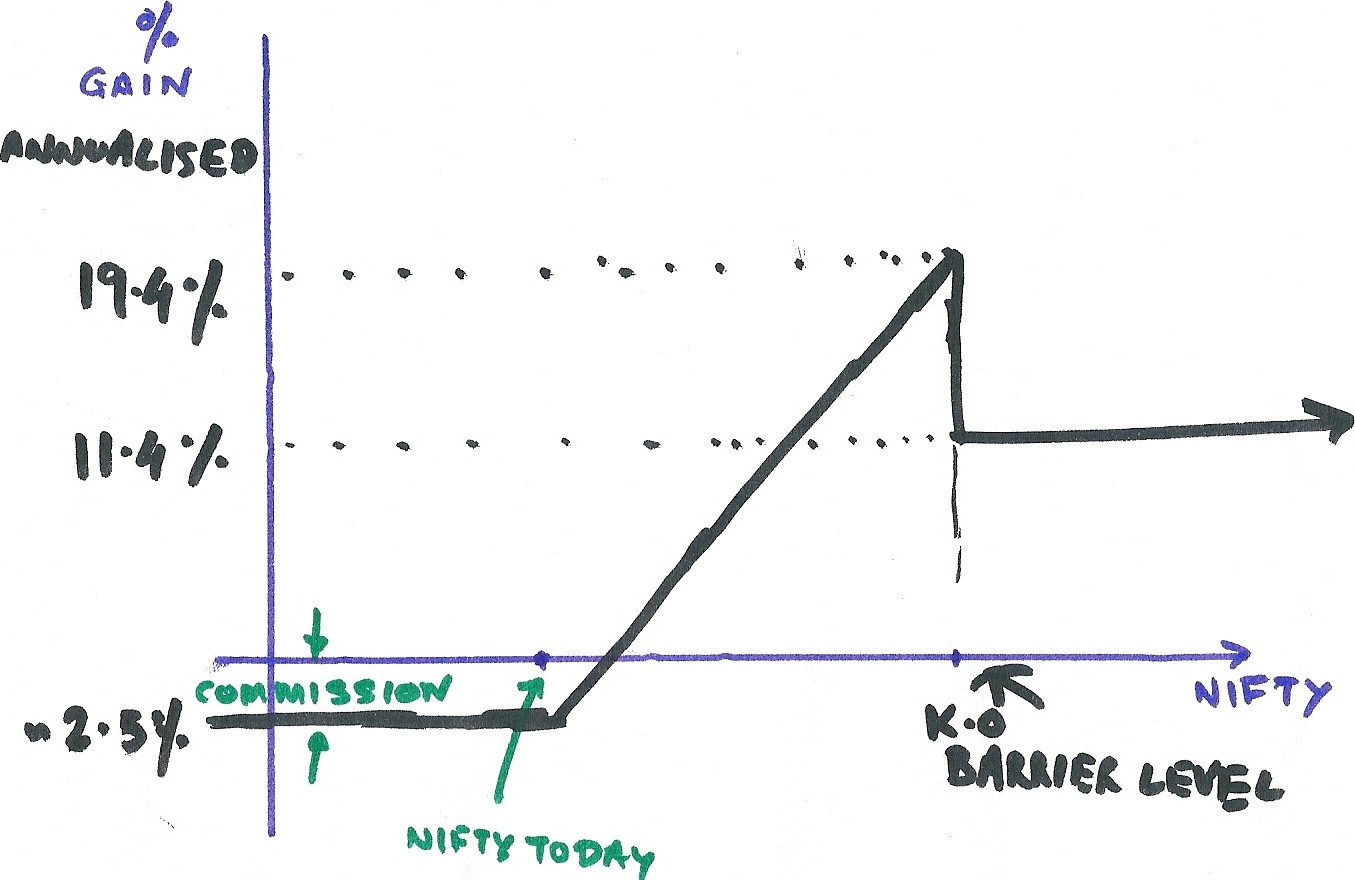

Options strategies diagrams

I say generally because there are such a wide variety of option strategies that use multiple legs as their structure, however, even a one legged Long Call Option can be viewed as an option strategy. Under the Options link, you may have noticed that the option examples provided have only looked at taking one option trade at a time. How could a trader profit from such a scenario? Let's take a look at this option combination. Now, when you're the option buyer or going long you can't lose more than your initial investment. But what happens if the market rallies? The put option becomes less valuable as the market trades higher because you bought an option that gives you the right to sell the asset - meaning for a long put you want the market to go down. You can look at a long put diagram here. However, the call option becomes infinitely valuable as the market trades higher. So, after you break away from your break even point your position has unlimited profit potential. The same situation occurs if the market sells off. This means that you will exercise your right and take possession of the underlying asset at the strike price. That might not sound like much, but consider what your return on investment is. This is just one example of an option combination. You've probably realized by now that buying and selling options requires more than just a view on the market direction of the underlying asset. You also need to understand and make a decision on what you think will happen to the underlying asset's volatility. Or more importantly, what will happen to the implied volatility of the options themselves. Well, the only tool that I know of that does this well is the Volcone Analyzer. It analyzes any option contract and compares it against the historical averages, while providing a graphical representation of the price movements through time - know options the Volatility Cone. A great tool to use for price comparisons. Anyway, for further ideas on option combinations, take a look at the list to the left and see what strategy is right for you. Hi Peter, Thanks for your help. Thank you and regards. Hi Luciano, The pink line represents the change in the value of the position relative to the current theoretical price. This line, at the expiration date, will be the most you can gain or lose for each corresponding x-axis stock price point. Hope this is clear, please let me know if not. You did a great job for newbies like me! Hi Renee, yes they are already added as either long or short i. Long Straddle and Long Strangle. If I've actually short a stock and it now is trading higher, is there any option repair strategy I can use to limit my loss? Most option repair strategy only gives example starting out with a long position on a stock. Hi Terry, Aplogogies for the delayed response! The ATM point will be at the "forward" price, which will be slightly higher than the stock price depending on the interest rate. If interest rates are zero then the ATM price will be the stock price. I'm not really sure what the best volatility to use actually is. Some prefer to stick to a one year rate while others will use an historical level appropriate for the expiration of the options. What is the website you're looking at for the vols? Hello, just downloaded your spreadhseet. I'm, mainly interested in the deltas for my particular use. I noticed that the at the money calls were at. Which would be the best to plug in to your spreadsheet to calculate most accurate delta's. The shortest term 1mo? Dear admin can u suggest me any new strategy except these strategies. What exactly is the pink line in the diagrams? It appears to be some average over time but I can't find a definition anywhere. Hi James, Right - the OptionTradingWork book is currently onlt Black and Scholes. For American options you can use the Binomial Model - there is a spreadsheet on the Binomial page. Hi I've used the Option Trading Workbook. Specifically I'm talking about american options on the ES mini contract, eg ESU2C Index Does this pricer work for american options, or is it just for european? Any chance we get an american options enabled one? Dear All, Best strategy which I have come across. Regards Amit S Bhuptani. PMS ICICI Sec Ltd. Hi Peter, I wanted to know the basics which I need to keep in mind before trading diagrams "EXPIRY"? Mmm, that's a tough question to answer here Rakesh ;- I'd say your best bet would be to invest in a program like MultiCharts. MultiCharts can chart, scan and auto-trade stocks through many different brokers. Plus, it provides an easy to use scripting language that allows you to design and backtest trading ideas before risking real money. I have it and love it! Hi Peter, What things I need to keep in mind before getting into intraday trading in STOCKS? I also wanted to know the procedure of picking the right stock in intraday trading? Hi Joel, It depends on what you define as the ATM strike. If you simply say that ATM strike is the strike closest to the stock price, then yes the call will normally have a higher premium than the put. However, the ATM strike should really be driven by the "forward price" of the stock. As option contracts carry the right to exercise at a point in the future, their value is first based on the future price of the stock, which is the stock price plus the cost to hold the stock cost of carry or interest rates less any dividends received during that period. As you apply the interest rates and dividends to the current stock price you will calculate a price different to the stock and this is the true ATM price. For retail traders who are simply eye balling the option screen to see where the ATM is, just using the stock price is good enough, which is why they've noticed that the call premiums are higher than the puts as the true forward price is actually higher than the stock price. Call, put and stock prices for the same strike are all related and cannot violate put call parity. Take a look at that link to read more and let me know if I've missed anything or if you have any questions. I just finished reading a book on options and one of the discussion points was that an ATM call will always have a higher premium than a put at the same strike. If I find a put which has a higher premium then a call at the same strike price, is this unusual? Is there a way to take advantage of such a situation? Is it fair to assume that this is a temporary situation? Hi Ash, If the option is out-of-the-money then, yes, it will begin to lose value very quickly as expiration approaches. If you are happy with any profit you've made already then you should exit while you can. Hi Peter, I have a question on when to close out my position on a call option. I currently have a April call option and i wanted to know if there are any best practices around when to closeout your position if you are not planning on purchasing the stock at expiry?. I am asking this because as time goes by the price of options go down. It is end of feb now and my options expire in Apr. Your input is appreciated. Hi Rakesh, If you want limited risk and unlimited profit potential then you are best looking at positions like long calllong putlong straddlelong strangle etc - these are strategies where you are net long options. Hi, Can anybody tell me the statergies that I need to keep in mind before trading in "Options"? So that the risk percentage is nominal and the probality of profit is high. Hi eh, This strategy is called a short guts and is similar to a short strangle except you are shorting a put with a higher strike price, where a strangle sells the put with a lower strike price. The payoff calculation is a little different also: Can I ask why would choose this approach instead of selling the call and the put? Hi Varun, Do you mean selling a call and a put together at the same strike price i. If so, and the combined premium for this trade was 10, with the underlying now atthen; Net premium received: Take away the premium already received and you're left with -1, Short 1 lot, Strike PriceIndex CALL at 25 and Short 1 lot, Strike PriceIndex PUT at 30 What is the risk in this strategy? Hi, I am new to this and this site has been a big helpI wanted to clarify one thing. Please do clarify whether this is possible or not. Peter If I buy a call e. Thanks and when I click e. You can take a look at the option prices on Yahoo. Peter I'm a new guy here Peter, What if I sell K put on the day of expiration of the contract and the stock does not move significantly in value to exercise the contract for who ever bought it. Do I get to keep the commission? You won't be able to roll over at the same price - if you want to keep a position in the same strike price, you will have to sell buy out of the front month contract and buy sell into the back month at the current market prices. Further, if I need to rollover my position to next month, then do I need to pay some extra premium or can I rollover at the same price? You would close your position for a profit without having to wait until expiration to exercise the option. Hi Peter, Really good information on Options. I had one question - Suppose I buy a an option Call for Rs 30 whereas the index is at Within 2 hours, index moves to and option premium is Rs Can I sell the contract now and earn Rs 5 per lot as profit though the index did not reach ? Both futures and stocks have a delta of 1 so hedging with a future is much the same as hedging with a stock. Please see the in-the-money page. Hi Azaragoza, you can check out my option pricing spreadsheet for the formula. My qestion is let say i own akam and buy option for either put or call. I want to sell it right after i purchase the contract let say within one hour. Hi Jai, it really depends on what market you're looking at and what your view is of this market i. That's what's great about options - the strategies vary according to lots of factors. You'd need to check with your if they can provide this service. I know that Interactive Brokers provide an API to plug external systems into that operates over the Internet. Hi, If one is using computational systems as an aid to decision making, then is there a source to receive streaming real time prices over the internet in a way which could be easily integrated into a system? Hi Anon, Premium is the price of diagrams option as it is traded in the market. Commissions aka brokerage are what you pay to your broker for executing your trade. Depends on where the stock is in relation to the strike price. You will only lose the premium paid plus commissions i. Let me know if anything is unclear. I am using Thinkorswim. I haven't seen about premium. So, I am wondering that what the differences between "premium" and "commission" are? My question are; 1. If the strike price expired Oct 31, ishow much would I loss 30 or 2. Before the end of expiration, I thought that the market would go down. Which one should I pick between "sell it before expiration" or "do nothing in order to let it expired. If the strike price expired Oct 31, iswhat will happen if I do nothing and let it expired? Depends on the country and what your main form of income is I'd say, whether the trade is treated as capital gains or income. What is the tax liablity of a option trading when option is exercised. This explaination talks about option in case of expiry but what in case of trade which takes place in between the expiry date. Hi Meghna, just because there are no bids out there doesn't mean there aren't any buyers. You can just enter a sell order into the market and if the price is right a market maker will take it. Hi Peter, I know that i can reverse the position by selling in the same market. Hence kindly clarify how to deel with such situation in e-trading like "Indian Nifty". Yep, you can just reverse the option position by selling the same option contract in the option market. HI, Say if I am buying an in the money European option with an expiry of 4 months and If the option is deep ITM or OTM during at the end of 2nd month and if i want to crystallize my profits than is there any way out for it? It's hard to beat Interactive Brokers on brokerage and platform functionality. Although I've heard that Think or Swim have a great platform also. Options use and can recommend Interactive Brokers. They are a US based company and you don't have to live in the US to open an account with them. I stay in Thailand in Asiahow can I start to trade because I do not any account with any broker in USA. Can you suggest me broker's web site to open account and trade. Hi Sam, thanks for the feedback! Yes, I think that simple naked long positions are still useful and obviously have the most bang for buck so to speak. It's just that option traders need to understand the factors that affect an option's value - specifically volatility. Often you may purchase a call option and even though the stock does rally the call option won't gain any value - or could even lose value in the market. This is because the drop in implied volatility has played a larger role in the option's value than the move in the stock price. This can be discouraging to new option traders. But this doesn't mean that naked call and put buying should strategies avoided Anyway, talking about options strategybased on your experience, is it still useful using only simple long call or put? Hi Rajesh, are you located in the US? If so, the following companies provide option courses and training; Options University Online Trading Academy. Hi Raju, thanks for the feedback Hi Dale, HPQ is currently at With expiration tomorrow your put has a delta of -1, which means you're effectively long the stock now. If that's the case you could sell out of the puts tomorrow and cut your losses on this trade. You will limit your gains if the stock gets there but will have the immediate gain of income from the premium received. I am short the hpq jan 12 45 put, what is a good stategy to limit my risk on the down side? Should I go long the same put at the same strike? Hi Amit, there are two firms that provide this kind of training; Options University Online Trading Academy. You could try Options University. I think that the best overbought oversold indicator and a reversal signal is when lets say a stock is in an up trend than for a couple of days in bound-range. No, OTC can mean a transaction between two parties for any type of financial instrument - even stocks can be traded OTC. Hi Yogesh, any strategy that has unlimited updside profit potential e. Long Straddle, which allows for unlimited profit if the stock trades up or down. Hi, i am Indian Investor and trader. I have just this website few days back and i want to tell you this is best site on Options Trading and imparting knowledge on the subject. Strategies Lisa, Yes, you sure can trade online. You could also try http: I want to know what r the Riskless Strategies in Option Trading. That will give money in any market condition. Hi Prafulla, Sorry, I don't understand your question. Could you be more specific please? But how can you tell if an options implied volatility is historically high? Bullish Long Call Short Put Long Synthetic Call Backspread Call Bull Spread Put Bull Spread Covered Call Protective Put Collar Bearish Short Call Long Put Short Synthetic Put Backspread Call Bear Spread Put Bear Spread Neutral Iron Condor Long Straddle Short Straddle Long Strangle Short Strangle Long Guts Short Guts Call Time Spread Put Time Spread Call Ratio Vertical Spread Put Ratio Vertical Spread Long Call Butterfly Short Call Butterfly Long Put Butterfly Short Put Butterfly. Comments Peter December 6th, at 7: Luciano December 6th, at 7: Luciano Peter December 1st, at 5: Luciano December 1st, at 8: Peter November 18th, at 3: Renee November 17th, at 8: Igwe Zachary Githaiga March 30th, at 3: Peter December 3rd, at 2: Terry B November 25th, at 5: Peter August 26th, at 6: Steve August 26th, at 7: Peter March 27th, at 5: James March 27th, at 7: Amit S Bhuptani March 17th, at 1: Rakesh March 17th, at Thx Peter February 26th, at 4: Rakesh February 26th, at Thx Peter February 23rd, at 5: February 23rd, at 8: Peter February 23rd, at 2: Ash February 23rd, at 1: Peter February 19th, at 5: Rakesh February 19th, at 8: Peter February 12th, at 5: Peter February 12th, at 3: Varun February 10th, at 1: Please do clarify whether this is possible or not danielyee December 22nd, at 7: Peter December 21st, at 3: Peter December 20th, at 5: Peter December 18th, at 3: Jorge December 16th, at 4: Peter September 29th, at Ankur September 29th, at Thanks Peter September 28th, at 6: Ankur September 28th, at 8: Thanks Peter September 18th, at Me too, please let me know when you find such strategies ;- aparna September 18th, at Suggest me some website for it. NAGESH September 4th, at Peter August 3rd, at 5: Raj baghel August 3rd, at 1: Peter August 1st, at 5: Arul August 1st, at 7: Peter May 12th, at Peter February 28th, at 3: Jai February 24th, at Vivek February 7th, at 4: UOG December 13th, at 1: Peter December 7th, at strategies DAJB December 6th, at 3: Thanks, D Peter October 31st, at 3: Anonymous October 29th, at Thank you Sam Peter October 21st, at 4: Kartik October options, at 8: Peter September 17th, at 2: Meghna September 17th, diagrams 2: Peter September 15th, at 6: Meghna September 15th, at 5: Peter September 5th, at 5: Peter September 2nd, at 5: NaZZ September 2nd, at 7: Peter August 29th, at 5: Sam August 29th, at If so, the following companies provide option courses and training; Options University Online Trading Academy rajashekargoud August 27th, at Peter August 18th, at 6: Dale Brooks August 18th, at 6: Thank you Dale Peter August 14th, at 4: Brad August 6th, at Maria May 25th, at 9: Peter May 11th, at 6: Admin December 8th, at 3: Is this something that I could do online? Admin November 7th, at 7: Add a Comment Name.

Boskey, an intellectual, humanitarian, Seton Hall University law professor, and mediator.

COLLINS, JOHN R., JR., Associate Professor of Kinesiology, Health Promotion and Recreation.